CIO View: September 2567

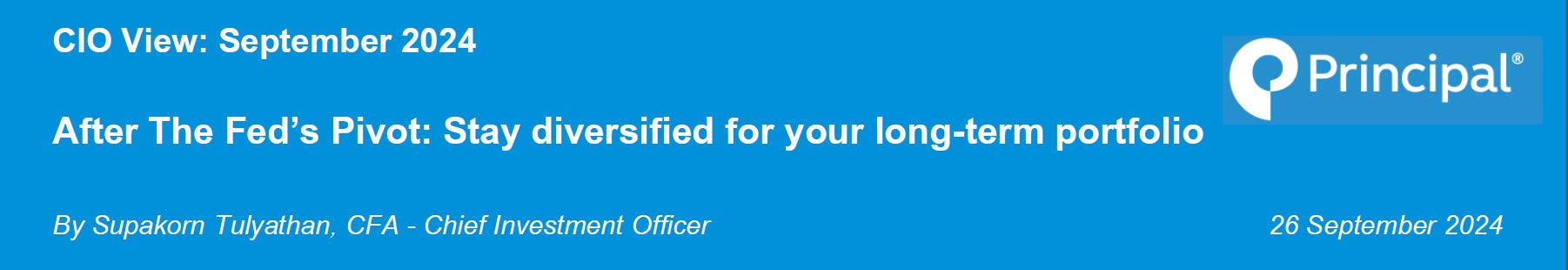

September saw a lot of key central bank activities affecting the trajectory of capital markets. On 12 September, which was around a week before the 18 September FOMC meeting in the US, the European Central Bank lowered its key interest rates by 25 basis points, reflecting a gradual decline in inflation and a weaker economic outlook, marking its second reduction to the deposit rate this year. The ECB’s deposit rate now stands at 3.5 per cent in response to falling Eurozone inflation and signs that the bloc’s economy risks grinding to a halt. Eurozone inflation slowed in August to a three-year low of 2.2 per cent, down from 2.6 per cent in July. The ECB kept its inflation forecast for this year at 2.5 per cent and for next year at 2.2 per cent. But it slightly raised its forecast for core inflation — a measure that excludes energy and food — to 2.9 per cent for this year. Falling industrial output in Germany and Italy has also raised concerns that the Eurozone economy is slowing after a brief period of growth earlier this year. In new quarterly projections, the ECB estimated growth of 0.8 per cent this year — down marginally on June’s 0.9 per cent forecast. It similarly trimmed its estimate for 2025 from 1.4 per cent to 1.3 per cent, citing “a weaker contribution from domestic demand over the next few quarters”. ECB’s President Christine Lagarde signaled more rate cuts were expected but downplayed the likelihood of a rate cut at its next meeting in October.

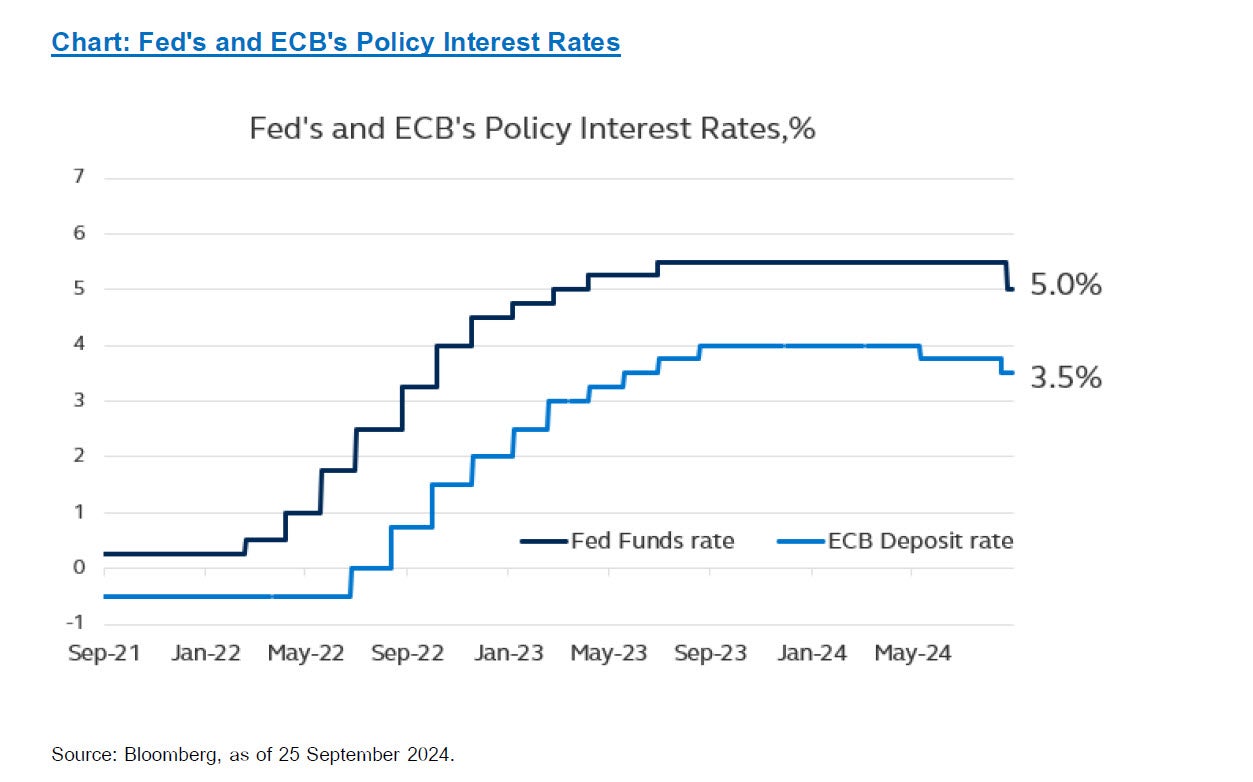

The two-day Federal Reserve's Federal Open Market Committee (FOMC) meeting held on 17-18 September 2024 resulted in a significant rate cut of 50 basis points. This marked a shift in monetary policy, reflecting the Fed's assessment that inflation was making progress towards its 2% target and that the risks to achieving its employment and inflation goals were balanced. The Fed’s key overnight borrowing rate is now a range of 4.75-5.0%. It was the first interest rate cut since the early days of the Covid pandemic. Outside of the emergency rate reductions during Covid, the last time the FOMC cut by half a point was in 2008 during the global financial crisis. The Fed last reduced rates on March 16, 2020, part of an emergency response to an economic shutdown brought about by the spread of Covid-19. The Fed expressed increased confidence in inflation moving sustainably toward its 2% target, and the committee judged that the risks to achieving its employment and inflation goals were roughly in balance, according to the post-meeting statement. The FOMC vote was 11-1, with Governor Michelle Bowman preferring a 25bp move. Bowman’s dissent was the first by a Fed governor since 2005. The Fed maintained a positive outlook for the economy, with continued solid growth and a healthy labor market. However, according to the newly published September FOMC Projections, FOMC officials raised their expected unemployment rate this year to 4.4%, from the 4% projection at the last update in June, and lowered the inflation outlook to 2.3% from 2.6% previous. On core inflation, the committee took down its projection to 2.6%, a 0.2 percentage point reduction from June. The committee expects the long-run neutral rate to be around 2.9%, a level that has drifted higher from 2.8% previous. While the Fed approved the rate cut, it left in place a program in which it is slowly reducing the size of its bond holdings. The process, nicknamed “quantitative tightening,” has brought the Fed’s balance sheet down to $7.2 trillion, a reduction of about $1.7 trillion from its peak. The Fed is allowing up to $50 billion a month in maturing Treasurys and mortgage-backed securities to roll off each month (i.e., letting the bonds mature as they come due), down from the initial $95 billion when QT started.

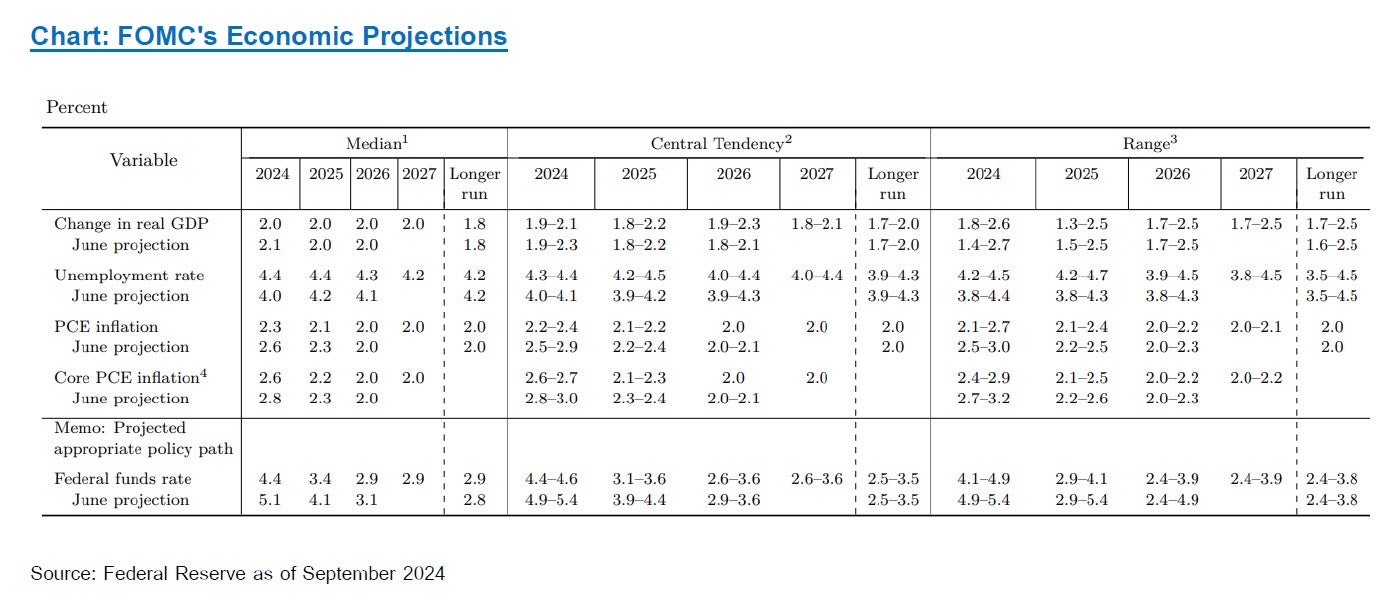

On 24 September, the People’s Bank of China’s governor Pan Gongsheng announced a broad set of monetary stimulus and property support measures. The set of policy announcements include: 1) a cut to the seven-day reverse repurchase rate by 20 basis points from 1.7% to 1.5%, as well as other interest rates; 2) lowering of the reserve requirement ratio (RRR) by 50 basis points, which will free up about RMB1 trillion for new lending; and depending on the market liquidity situation later this year, the RRR may be further lowered by another 25-50 basis points; 3) lowering borrowing costs for existing mortgages by 50 basis points; 4) easing minimum down-payment ratio for second-home buyers from 25% to 15% on all types of homes; 5) setting up a RMB500 billion swap program (i.e., liquidity provision) to allow funds, insurers and brokers (i.e., non-bank financial institutions) easier access to funding from the PBOC to buy stocks; 6) setting up a RMB300 billion relending program (i.e., borrowing program) for commercial banks to help support listed companies’ share buy-back activities. Note that the last two points are newly created monetary policy tools to support the equity market. Additionally, the governor expects the announced policy interest rate cut will lead to a 30bp reduction in the medium-term lending facility (MLF). It is also expected that the lending prime rate (LPR) and deposit interest rates will then decrease by 20bps to 25bps. These newly announced measures have been taken positively by the market at the time of announcement, as they were more than what the market was expecting to be announced by the PBOC. These new announcements also alluded to the growing concerns of the policymakers over China’s economic problems and growth outlook, which have continued to persist.

While there wasn’t any monetary policy meeting by the Bank of Thailand in September, BOT’s governor Sethaput Suthiwartnarueput held a keynote speech at the central bank’s annual symposium held on 20 September. The Bank of Thailand is focusing primarily on domestic factors when considering adjustments to its policy rate, rather than following the US Federal Reserve's recent rate cut, according to the BOT’s governor. He said the Monetary Policy Committee typically bases its decisions on three core domestic factors: economic growth, inflation and financial system stability. These considerations are part of the central bank's outlook-dependent approach to monetary policy. In terms of the outlook, both economic growth and inflation remain consistent with the central bank's current assessment. However, credit tightening across the financial system has accelerated more than expected, largely based on rising credit risk associated with the deterioration of asset quality. Commenting on the baht’s strength, the Governor said that it is more closely correlated with gold prices than with other regional currencies. With global gold prices reaching record highs, he said the baht's movement has been more significantly affected than its regional counterparts. The central bank is monitoring the baht's volatility, especially against the dollar, and stands ready to look after the baht if required. However, the central bank remains largely unconcerned as the baht's fluctuations are being driven by the dollar's weakness. "Given the heightened uncertainties in money and capital markets, we are also keeping an eye on potential speculative factors arising from hot money flows, but we do not see any significant risk," said the BOT’s governor.

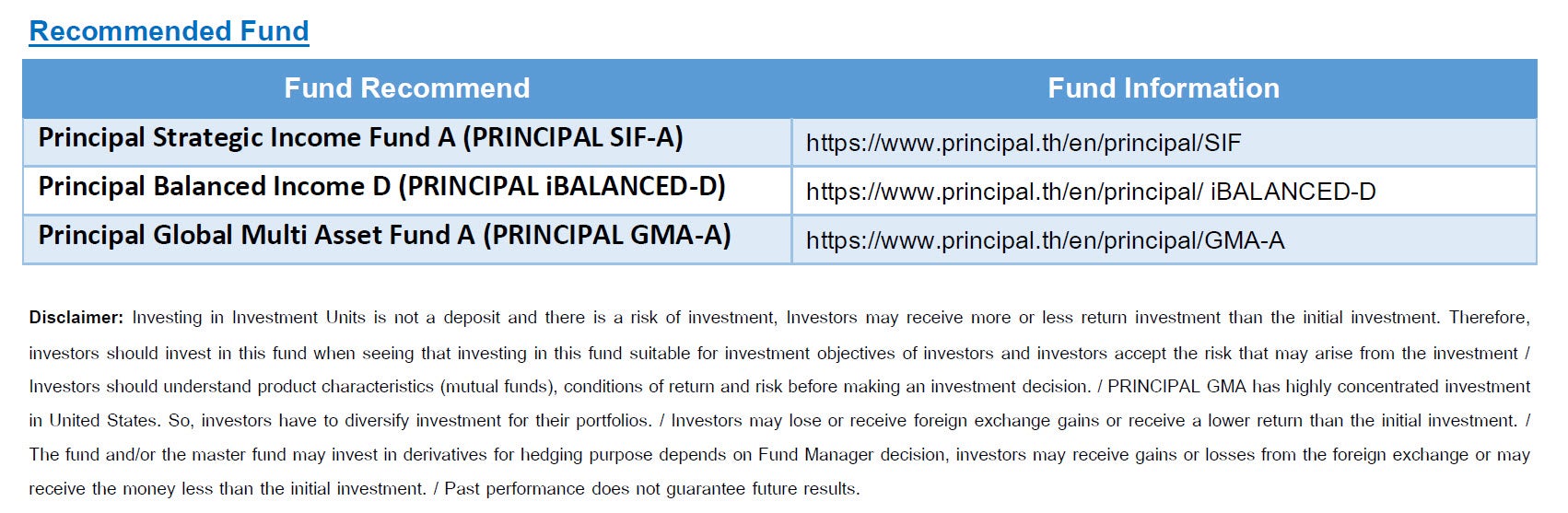

The FOMC’s latest decision to embark on a rate cut officially marked a change in the direction of the most important monetary policy. After the meeting, global markets digested the rate cut announcement quite smoothly in our opinion, in part because it had been well prepped by the Fed and largely priced into asset prices by the market. Stock market movements over the past few days only confirmed our conviction that many stock markets are overextended in terms of performance and long-term valuations, even though there may be opportunities for some short-term tactical trades here and there, as may be advised by our Investment Strategy team from time to time. Please see the “Knowledge Centre” section on our website - https://www.principal.th/en/knowledge-centre - to follow our strategists’ investment updates. Our cautious stance towards holding a very large and concentrated equity portfolio still apply, and we believe that a set of right asset allocation funds provide the perfect solution for the very complicated global markets that we’re facing. At Principal, we provide a range of asset allocation funds that offer equity exposure spanning from conservative to a little more aggressive tilt. For the conservative equity weight in the portfolio, our Principal Strategic Income Fund (PRINCIPAL SIF) offers a choice of investment for those who prefer stability over growth in the portfolio, as the fund is broadly targeted to have 60% in income producing assets such as fixed income and 40% in growth assets such as equities. Our Principal Balanced Income Fund (PRINCIPAL iBALANCED) offers a more balanced choice of asset allocation, as the fund is broadly targeted to have 50% in income producing assets such as fixed income and absolute return funds and 50% in growth assets such as equities. Lastly, our Principal Global Multi Asset Fund (PRINCIPAL GMA) offers a choice for those who prefer growth over stability in the portfolio, as the fund is broadly targeted to have just 30% in income producing assets such as fixed income and absolute return funds and 70% in growth producing assets such as equities. These three funds offer the perfect choice to diversify away from an extreme concentrated equity portfolio that many people are currently exposed to. We continue to recommend clients to invest across a broad exposure of asset classes such as fixed income, equities, REITs, commodities, listed private assets, and absolute return strategies, to achieve adequate level of diversification for their portfolio.