CIO View: October 2024

The US dollar has reached a high point in recent months as investors adjust their expectations for future interest rate cuts by the Federal Reserve. After a series of strong economic reports, the market's anticipation of aggressive rate cuts has diminished. Currently, the market is pricing in a high probability of a smaller, 25 basis point rate cut in November, compared to the previous expectation of a larger cut. This shift in sentiment has led to an increase in Treasury yields, particularly the 10-year yield, which has risen above 4.20%. As a result, the US dollar index has strengthened, surpassing the 104 level and gaining over 3% this month.

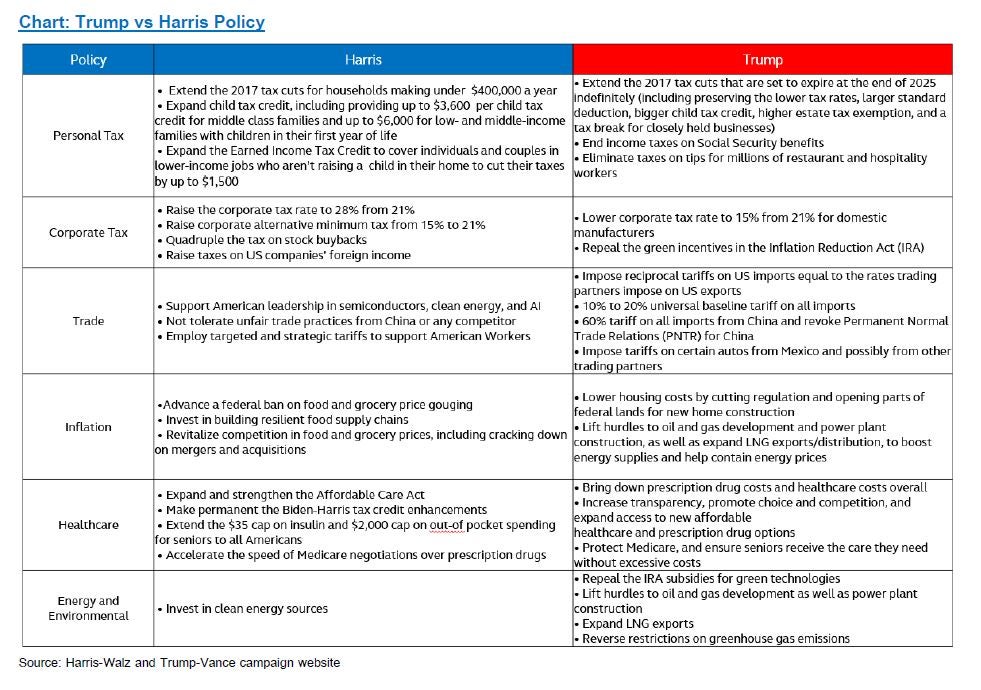

With just a few days to go before the votes are counted for the US election, investors have been weighing the risk of a Republican sweep, which is widely expected to be the most bullish election scenario for the US dollar. In a recent Reuters/Ipsos poll, Democratic US Vice President Kamala Harris held a marginal 46% to 43% lead over Republican former President Donald Trump. However, markets have recently been pricing a Trump win, along with the Republican control of Congress. The more recent US election poll conducted by CNBC reveals a more tightly contested battle for the two candidates. Nationally, former President Donald Trump holds a 48% to 46% lead over Vice President Kamala Harris, which is within the poll’s 3.1% margin of error. In the seven battleground states, Trump leads 48% to 47%, within the 4% margin of error of the poll. Americans head to the poll on 5 November 2024. They will face a clear choice for their president on that day, as the two candidates significantly differ on a number of key policies, such as inflation, taxes, abortion, immigration, foreign policies, and trade. However, the more deficit-inducing policies between the two candidates are those of Donald Trump, which have been pushing bond yields and US dollar as a result.

We’re also entering a reporting season from many of the big tech companies. While the market rally has broadened in recent months, the largest tech stocks co time to exert a powerful influence on the direction of the stock markets. The so-called “Magnificent Seven” group of big tech companies is expected to account for nearly all of the earnings growth of the US stock market for the third quarter, highlighting the importance of their earnings results to the continuity of the market rally. With the election contest between former President Donald Trump and Vice President Kamala Harris looking close, third quarter earnings season is going to add to the volatility of the stock market around the election period, on the back of the stock market that has been trading near all-time highs and with some of the most expensive valuations post-Covid.

Recall that on 24 September 2024, the People’s Bank of China’s governor Pan Gongsheng announced a broad set of monetary stimulus and property support measures. The set of policy announcements include: 1) a cut to the seven-day reverse repurchase rate by 20 basis points from 1.7% to 1.5%; 2) lowering of the RRR by 50 basis points, releasing 1 trillion yuan in liquidity; 3) lowering borrowing costs for mortgages and easing minimum down-payment ratio for second-home buyers from 25% to 15%; 4) allowing funds and brokers to tap PBOC funds to buy stocks. More recently, the PBOC has followed through on their announced expectation to cut the medium-term lending facility (MLF) and the loan prime rate (LPR). The 1-year LPR has been cut by 25 basis points to 3.1%, while the 5-year LPR has been cut to 3.6%. The 1-year LPR influences corporate loans and most household loans in China, while the 5-year LPR serves as a benchmark for mortgage rates, in line with prior announcement by PBOC governor Pan Gongsheng. This serves to confirm the significant determination of China’s central bank to provide a boost to the economy and the property sector, even though more stimulus would need to come from the fiscal side to be able to turn around the trajectory of China’s economy.

On October 16, 2024, the Bank of Thailand's Monetary Policy Committee (MPC) made a surprise decision to cut the policy interest rate by 25 basis points to 2.25%. The Committee voted 5 to 2 to cut the policy rate, with two members who voted to maintain the policy rate at 2.50 percent. While some members of the committee voted to maintain the rate, the majority favored the cut, which was aimed at stimulating economic growth and easing the debt burden on borrowers. The decision was also supported by the expectation that the lower rate would not hinder the deleveraging process due to slowing loan growth. The Committee deemed that the policy rate should remain neutral and consistent with economic potential. Moreover, it should not be at too low a level that would create build-ups of financial imbalances in the long term. The BOT governor Sethaput Suthiwartnarueput also made a post-meeting comment that the rate cut was appropriate, and that it was not a signal of the beginning of a rate-cutting cycle.

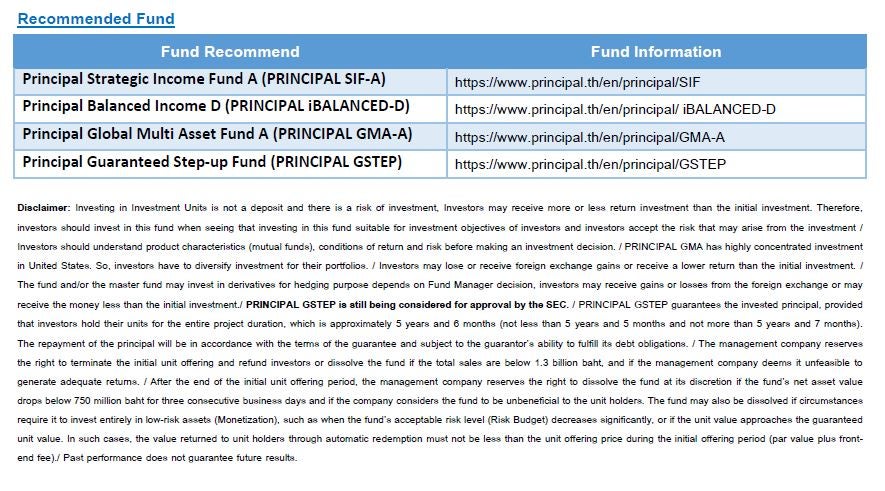

The confluence of events this quarter only serves to highlight the vulnerability of the markets that are overextended in terms of performance and long-term valuations, even though there may be opportunities for some short-term tactical trades here and there, as may be advised by our Investment Strategy team from time to time. Our cautious stance towards holding a very large concentrated equity portfolio still apply, and we believe that a set of right asset allocation funds provide the perfect solution for the very complicated global markets that we’re facing. At Principal, we provide a range of asset allocation funds that offer equity exposure spanning from conservative to a little more aggressive tilt. For the conservative equity weight in the portfolio, our Principal Strategic Income Fund (PRINCIPAL SIF) offers a choice of investment for those who prefer stability over growth in the portfolio, as the fund is broadly targeted to have 60% in income producing assets such as fixed income and 40% in growth assets such as equities. Our Principal Balanced Income Fund (PRINCIPAL iBALANCED) offers a more balanced choice of asset allocation, as the fund is broadly targeted to have 50% in income producing assets such as fixed income and absolute return funds and 50% in growth assets such as equities. Lastly, our Principal Global Multi Asset Fund (PRINCIPAL GMA) offers a choice for those who prefer growth over stability in the portfolio, as the fund is broadly targeted to have just 30% in income producing assets such as fixed income and absolute return funds and 70% in growth producing assets such as equities. These three funds offer the perfect choice to diversify away from an extreme concentrated equity portfolio that many people are currently exposed to. We continue to recommend clients to invest across a broad exposure of asset classes such as fixed income, equities, REITs, commodities, listed private assets, and absolute return strategies, in order to achieve adequate level of diversification for their portfolio.

Furthermore, we will be introducing another global multi-asset fund in the form of a guaranteed fund. This fund will have multiple layers of step-up guarantees to the NAV that change in tandem with the levels of the fund’s NAV. The guarantee will only be in effect if an investor holds on to the fund until the end of the fund’s life, which is set to be for five years and six months. This type of fund not only provides diversification in the form of asset allocation to the investors, the step-up guarantee mechanism also provides investors with a conditional protection that ensures some level of downside protection in the event that markets are negatively impacted by risk events. Please inquire about our Principal Guaranteed Step-up Fund (PRINCIPAL GSTEP) from our representatives and distribution channels. The fund will be offered via an IPO during 18 November to 4 December 2024.