CIO View: May 2024

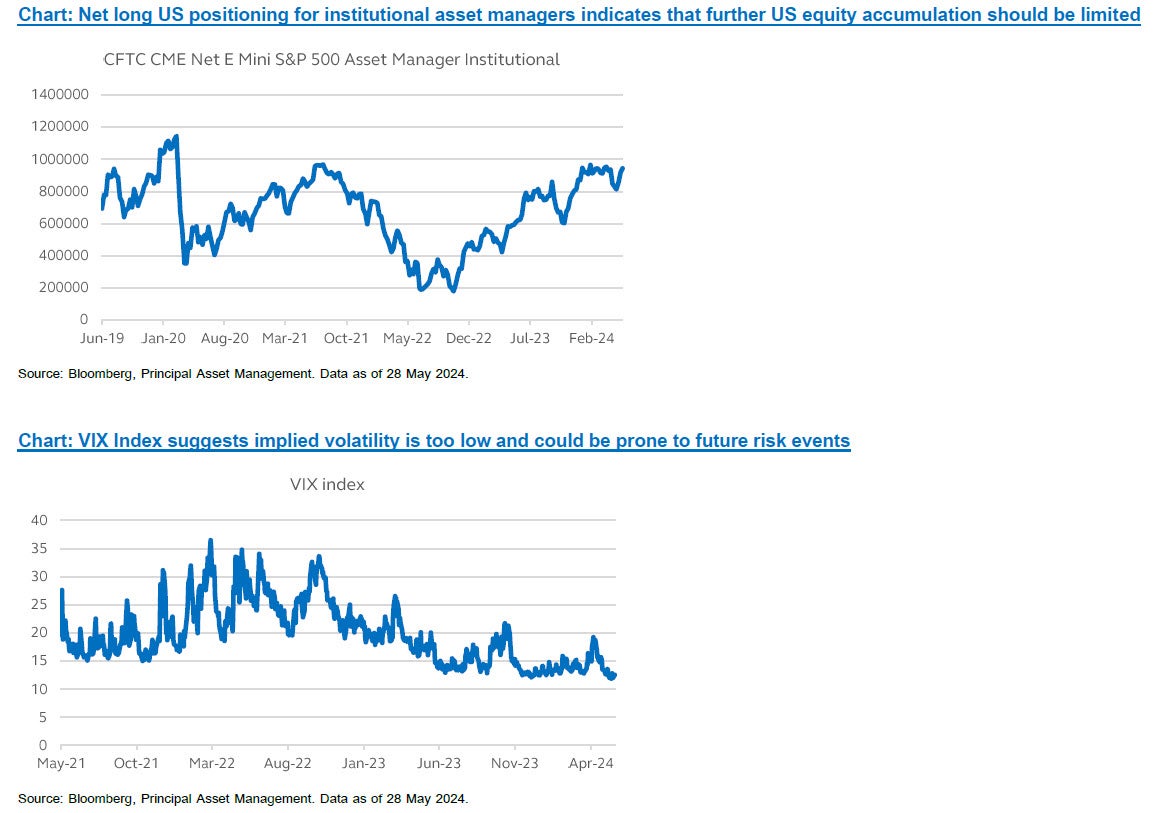

The Federal Reserve's (Fed) monetary policy decisions are highly contingent upon the inflation outlook. While recent months may see persistent inflationary pressures, particularly in labor and shelter costs, emerging data points suggest potential moderation. This, coupled with the recent economic data exceeding expectations on the downside, has restrained upward movements in bond yields. Aligning with the peak in the Fed's policy rate, US bond yields appear to have stopped increasing. Looking forward, the fixed income market may enter a period of consolidation. On the one hand, leading indicators signal a potential cooling of the labor market in the coming months. Conversely, inflationary pressures may exhibit persistence in the near term. Consequently, the Fed is likely to maintain a neutral stance, limiting significant upward or downward movements in yields. Our analysis of market expectations for future rate cuts by the Fed reveals a downward revision from six rate cuts at the beginning of the year down to around one to two cuts currently expected by the market. We have revised the Fed’s forecast from three cuts to two cuts in 2024, with the first one coming in September. The next substantial shift in bond yields is anticipated to be downward. However, this is contingent upon several months of consistently weaker inflation data, prompting the Fed to signal a potential rate cut.

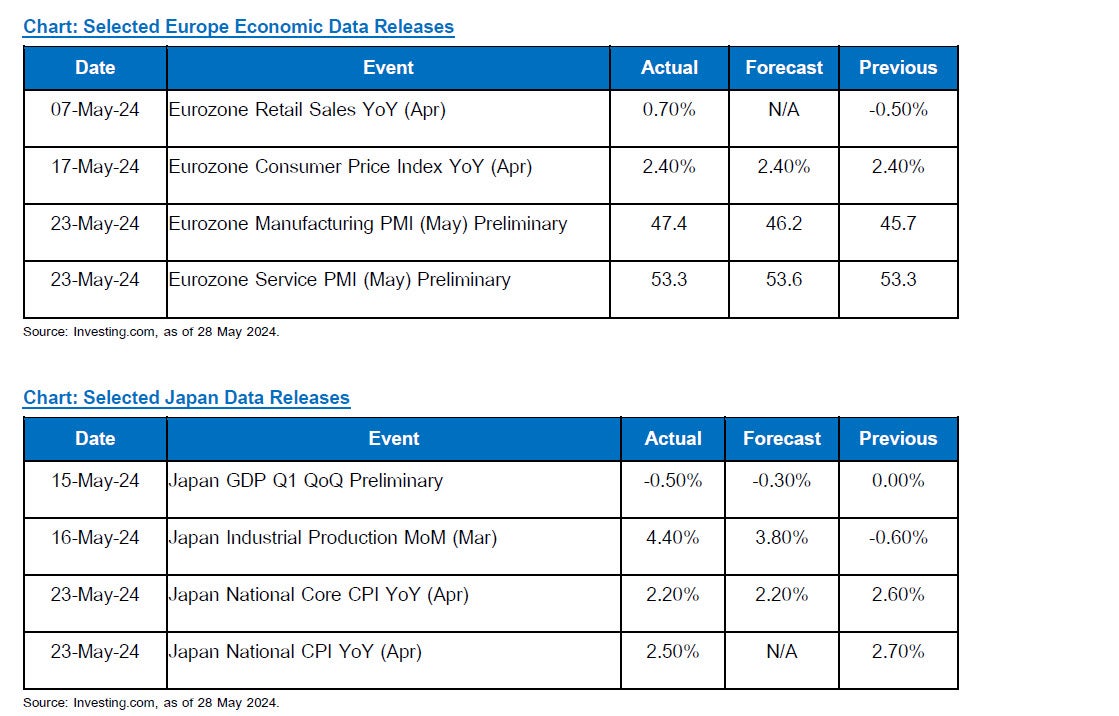

The European Central Bank (ECB) is signaling a rate cut next week, most likely by 0.25%, as inflation slows down in the Eurozone. This would make the ECB one of the first major central banks to loosen monetary policy, even though the US Fed is expected to hold rates steady for now. The ECB aims to bring inflation down to its target of 2% but wants to avoid keeping rates too high for too long. The pace of future rate cuts will depend on incoming economic data, with slower pace of cuts expected if there are upward surprises inflation, and faster pace of cuts expected if there are downward surprises on inflation. The delays in the timing of the first Fed rate cuts have pushed up US bond yields in the year-to-date, which have also pushed up bond yields in Europe, indirectly providing a tightening in financial condition to the Eurozone economies. This means that the ECB will need to offset this indirect tightening effect by going ahead with the rate cut in the Eurozone, even if the Fed decides to hold off on the rate cuts for now.

Japan’s 10-year bond yield recently climbed above 1.00% level for the first time in 11 years, as investors continued to price in higher interest rates as part of the Bank of Japan’s (BOJ) historic shift in monetary policy away from its long-held Negative Interest Rate Policy (NIRP). The bond yields have risen steadily since beginning of the year, as the BOJ has also surprised the market by buying smaller-than-expected amount of mid-term to long-term bonds into its balance sheet. In March, the BOJ abandoned its explicit policy of using bond purchases to cap the 10-year bond yields, but has continued to buy the bonds into its balance sheet to avoid abrupt shocks to financial markets. Meanwhile, the yen has been trading at around 155-156 over the past month, and even breaching 160 level at the end of April, which was a 34-year low, as the BOJ held its policy at 0.0%-0.10% last month. The yen’s volatility appeared to have calmed down in May, as analysts have speculated that the Finance Ministry had entered the market to intervene. Market expects the BOJ to increase its policy rate again sometime in Q3.

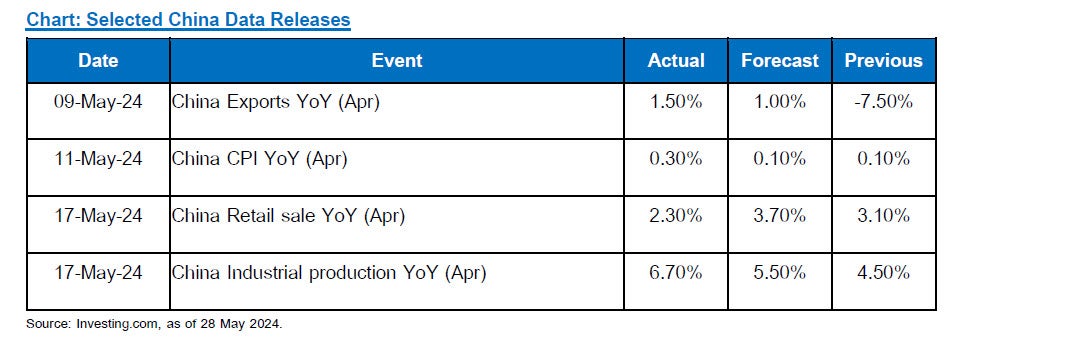

Recent policy pronouncements from Chinese policymakers demonstrate a renewed sense of urgency and willingness to address long-standing economic challenges. A key area of focus is the property sector, burdened by a significant overhang of unsold inventory. This factor has exerted a persistent drag on both the real estate market and the broader Chinese economy. Significantly, China's latest measures represent a marked policy pivot. Following a period of stringent regulations aimed at curbing excessive leverage within the real estate sector, authorities have unveiled a three-pronged approach to stimulate a housing market revival. Firstly, demand-side measures include the relaxation of home-purchase restrictions in most cities, the removal of minimum mortgage interest rate requirements, and a reduction in the down payment threshold for first-time homebuyers. Secondly, to address the supply glut, local governments are being encouraged to acquire unsold units from developers and subsequently convert them into social housing projects. Thirdly, with the aim of alleviating liquidity constraints faced by developers, regulators have implemented a "white list" system, granting select projects access to commercial bank financing. An anticipated improvement in China's economic growth trajectory, driven in part by a revitalized housing market, is likely to serve as a positive catalyst for commodity prices and regional growth prospects throughout Asia, including Thailand.

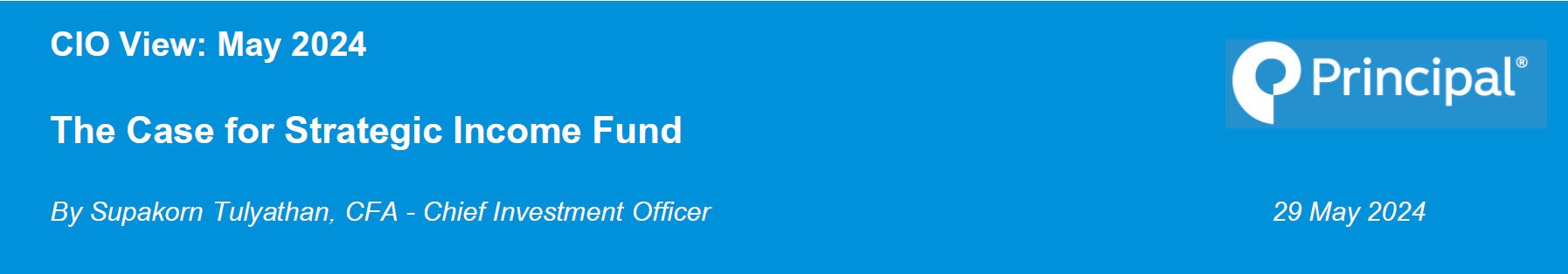

Recent global manufacturing surveys paint a cautiously optimistic picture, indicating an upswing in both domestic and global manufacturing activity. This positive sentiment is bolstered by rising Chinese growth indicators and a significant recovery in their domestic equity market. Following a period of necessary correction, the global equity markets have exhibited renewed strength as the relentless rise in bond yields appears to have leveled out. This confluence of factors may argue for a more favorable runway for continued positive equity performance. Firstly, the probability of disruptive tailwinds, such as aggressive rate hikes or an abrupt economic slowdown, has diminished. Secondly, the recently concluded Q1 earnings season in the US continued to deliver positive surprises. This trend is further supported by rising business confidence and decelerating unit labor costs. These factors collectively suggest an environment conducive to further acceleration in corporate profits, driven by strong productivity and improving Purchasing Managers' Index (PMI) orders. Consequently, this provides positive support for equities to climb higher on the back of improving earnings, even if high interest rates exert some moderating influence on valuation multiples. A combination of moderating inflation, a synchronized global growth rebound, and positive corporate earnings trends creates a compelling investment case for continued equity market strength. However, a degree of caution is necessary, due to some headwinds from high valuations and market technicals that are becoming noticeable.

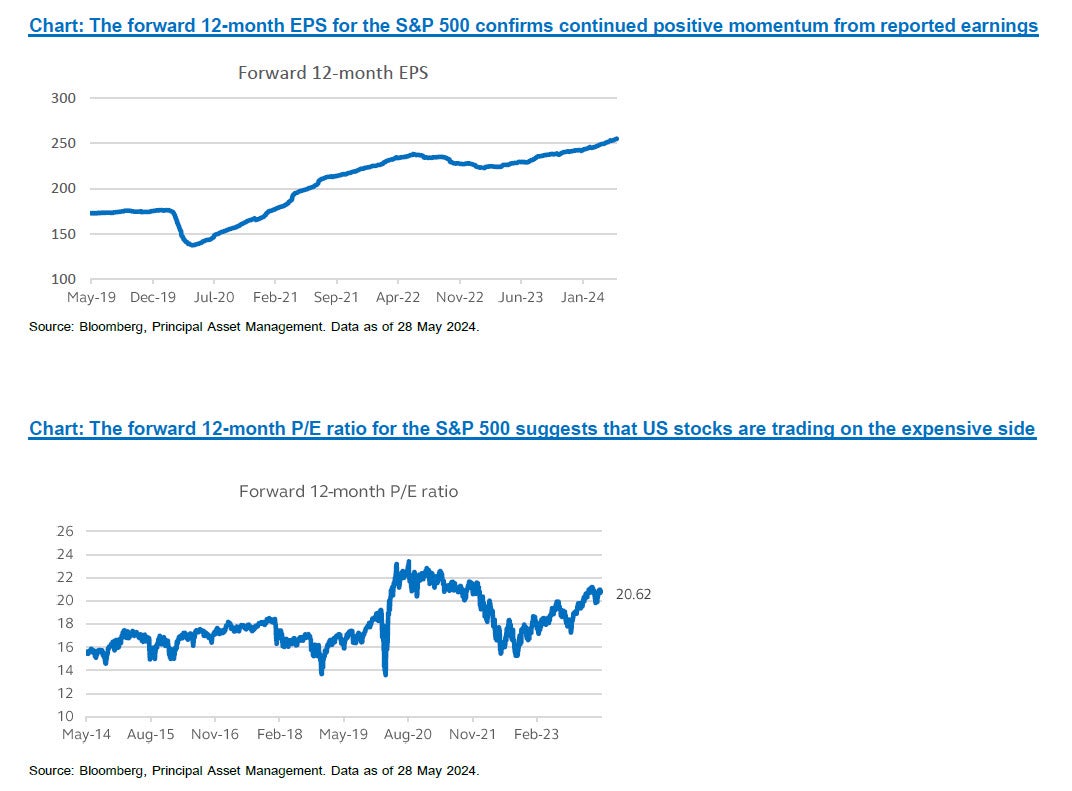

Building fears of a fresh policy shock in April have largely reversed, fueled by a mix of steady Fed, softer US growth, and modestly better US inflation outcomes. That reversal has been enough to break the uptrend in bond yields, push equity markets to fresh highs, and push volatility down sharply. Weaker US growth has so far been viewed as a positive by reopening a path toward rate cuts. Looking back over a longer period, the equity market uptrend in the recent couple of years has been concentrated in a handful of mega cap tech stocks. Several calculations by Wall Street analysts have indicated that US stocks excluding the Magnificent 7 big tech (“Mag 7”) is up by about 20% since the beginning of 2023, while the Mag 7 stocks have nearly doubled. The highly concentrated rally in just a few mega-cap stocks, along with high stock market valuations, low VIX index level, and high level of net long positioning on US stock market, suggest that some corrections are due to happen over the foreseeable horizon, or at the least, some spikes in volatility may happen. As we head into the summer, there are still potential disruptions to consider. The primary risk is still that the inflation data stays uncomfortably high, and that the move higher in bond yields resumes. As we move toward the first US presidential debate in late June, election risks may also come into focus, which could also disrupt the positive momentum seen in the global equity markets. Given that we foresee a bumpy road ahead for the global equity markets, albeit with continued positive support from earnings, while the high bond yield levels should continue to provide a source of attractive and stable income, our recommendation is toward investments that have adequate degree of asset allocation diversification such as our Principal Strategic Income Fund (PRINCIPAL SIF). The fund is broadly divided into 40% equities and 60% bonds. This type of fund should provide comfort during equity market turbulence from reduced equity exposure to 40% versus holding a 100% equity exposure, and getting the stability and yields from the 60% allocation to fixed income.

Recommended Fund

Fund Recommend | Fund Information |

| Principal Strategic Income Fund A (PRINCIPAL SIF-A) | https://www.principal.th/th/principal/MAINCOME-A |

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / Investors may lose or receive foreign exchange gains / or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.