CIO View: March 2025

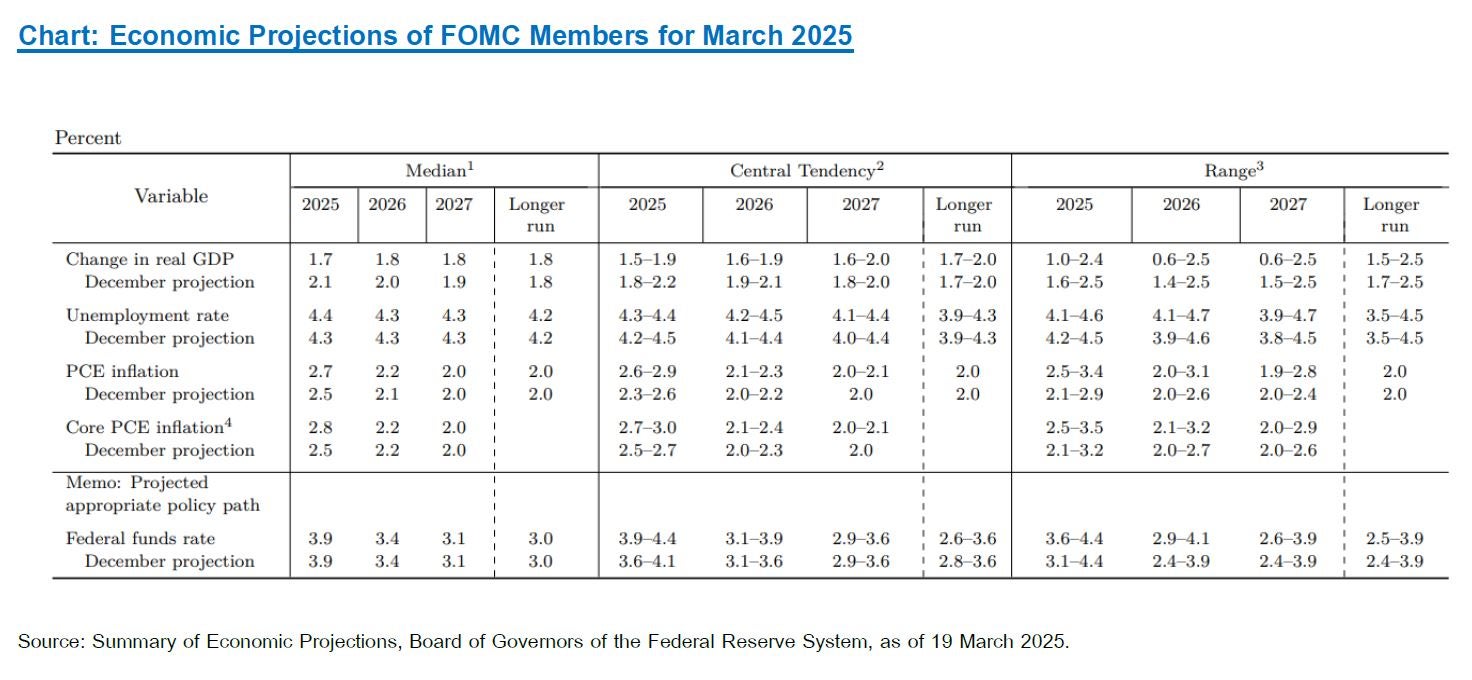

The Fed kept its benchmark interest rate at its target range of 4.25% to 4.50% at its meeting on March 18-19 as widely expected by the market. After the meeting, when asked about the next meeting in May, the Fed Chair Jerome Powell indicated that they are in no hurry to cut. The FOMC has revised down their forecasts for economic growth, while revised up their forecasts for inflation, reflecting their increasing concern with the trade policy developments. The dot plot on expected Fed funds continues to show two more rate cuts by the end of this year, while expectations for other years also remained unchanged by the FOMC members. The Committee also made a technical adjustment to the Fed’s balance sheet reduction (Quantitative Tightening), lowering the caps of US Treasury redemption from $25 billion per month to $5 billion per month in a sign that the Fed prefers to have more liquidity in the system, while it could take longer for the balance sheet reduction to end in early 2026.

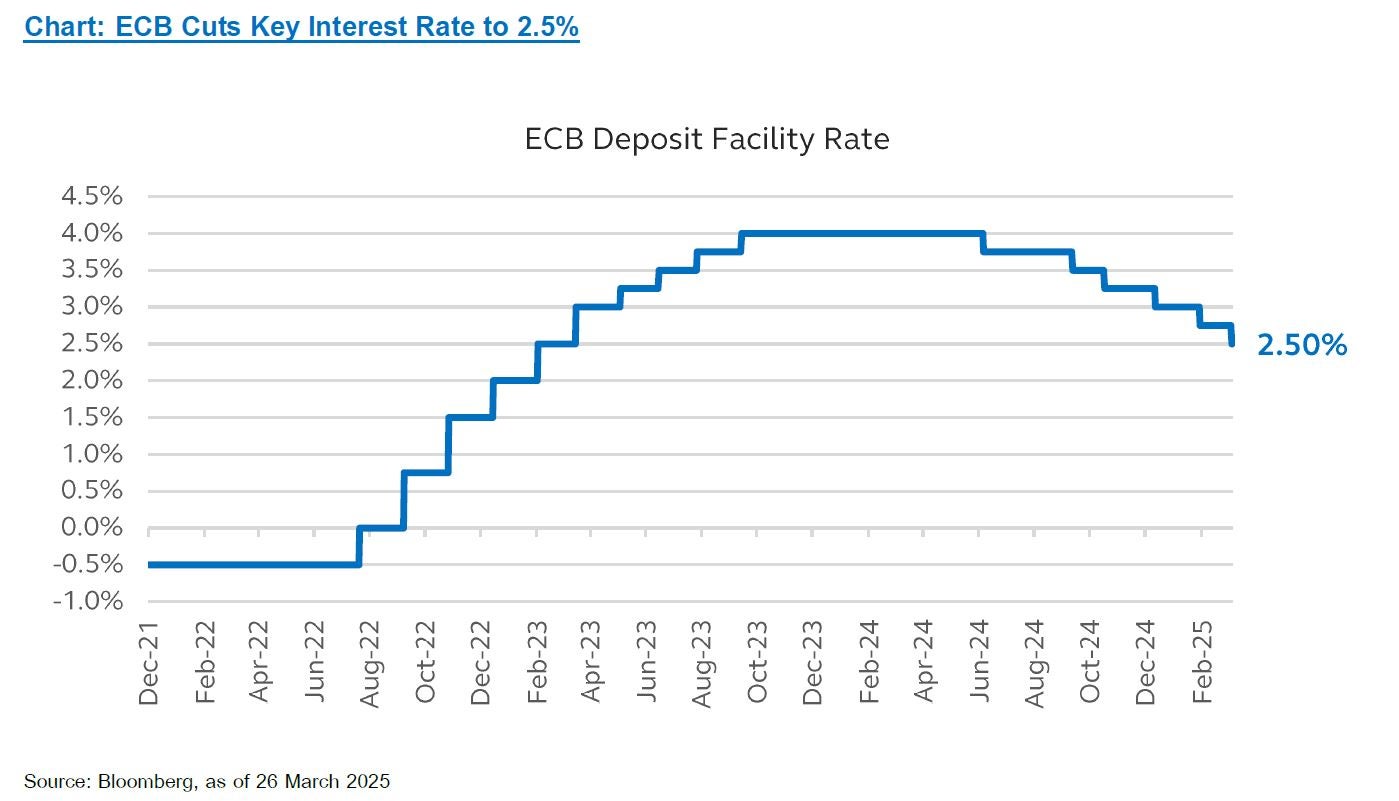

The ECB cut its deposit facility rate, its key policy rate, by 25 basis points to 2.50% on March 6, as widely expected by the market. ECB President Christine Lagarde did not indicate whether the central bank would hold rates steady at its next meeting in April, reflecting that the ongoing uncertainty meant it was important for the Governing Council to be data-dependent. Developments on US trade policy and the recent fiscal news from Germany and the Euro area are too limited for the ECB to draw any policy conclusions at this stage. Meanwhile, the wording in the statement around the policy rate being restrictive was also softened to indicate that their policy rates are now becoming meaningfully less restrictive. Similarly to the Fed’s direction, the ECB Governing Council revised down its expectations for economic growth, while revised up their expectations for inflation, as a reflection of stronger energy prices and the lower exports and investments due to increased trade and policy uncertainty.

The BOJ kept its policy rate steady at 0.5% at its meeting on March 19, as widely expected by the market. BOJ Governor Kazuo Ueda commented at the press conference that wage and price condition are on track but uncertainties from US trade policy make it difficult to assess the potential impact on inflation trend. The BOJ will keep track the upcoming economic data before adjusting its policy rate.

The PBOC left the 1-year loan prime rate at 3.1% and the 5-year loan prime rate at 3.6%. The PBOC held its first-quarter monetary policy committee meeting on March 18. In the meeting, the committee suggested stepping up monetary policy adjustment and control, and improving monetary policy to be more forward-looking, targeted and effective. The committee signaled that it will cut the reserve requirement ratio and interest rate at appropriate time to maintain liquidity and boost credit growth.

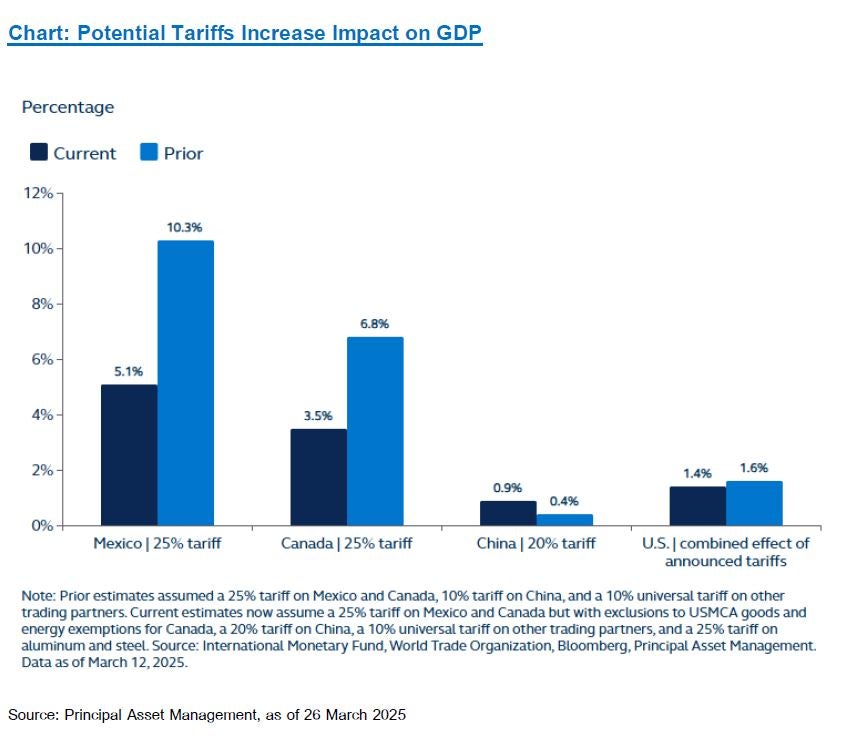

Trump imposed a 25% import tariff on goods from Mexico and Canada took effect March 4, with an exception for energy products and potash, which received a 10% tariff. The Trump administration later suspended those tariffs until April 2 on autos and all other goods under the United States-Mexico-Canada Agreement (USMCA), which is a trade agreement that replaced the North American Free Trade Agreement (NAFTA) that was entered into force on 1 July 2020. Trump hiked an additional 10% on Chinese goods, increasing the rate to 20%. Trump also imposed 25% on all steel and aluminum imports on March 12. Furthermore, Trump is planning to announce the reciprocal tariff which seeks to equalize U.S. tariffs with the duties charged by its trading partners, as well as tariffs on sectors like automobiles, pharmaceuticals, and semiconductors on April 2. However, recent news report on Monday, March 24 had reported that Trump might soften reciprocal tariffs he plans to impose on U.S. trading partners, and that some nations might be exempt; while other tariffs on goods such as automobiles, lumber, pharmaceuticals and semiconductors might not be implemented until later. Additionally, Trump said on Monday that the U.S. will impose 25% tariffs on countries that buy oil and gas from Venezuela, which could sharply raise levies on goods from China, who was the top buyer of Venezuelan crude in 2024. Trump said that the 25% tariffs on buyers of Venezuelan crude would come in addition to any existing levies. For China, whose tariffs to the U.S. have been raised to 20% so far by Trump’s administration, another 25% additional tariff would mean 45% tariffs on the U.S.’s third-largest trading partner.

On March 18, the German Parliament has approved the reform of the constitution to relax the debt brake rules and set up a EUR500 billion special fund for infrastructure investment which will be invested within the next 12 years. The easing of the debt brake and the provision of the special fund raise expectations of an upturn for the German economy, and specifically the infrastructure and defense sector.

The BOT announced a temporary relaxation of its loan-to-value (LTV) regulations for housing loan contract from 1 May 2025 to 30 June 2026. The revised rules allow for loans of up to 100% of the collateral value for second homes and subsequent units priced below Bt10 million as well as for all properties over Bt10 million, up from an earlier cap of 70-90%. The measure aims to support the slowing real estate sector and would help ease the expense burden for second-home buyers.

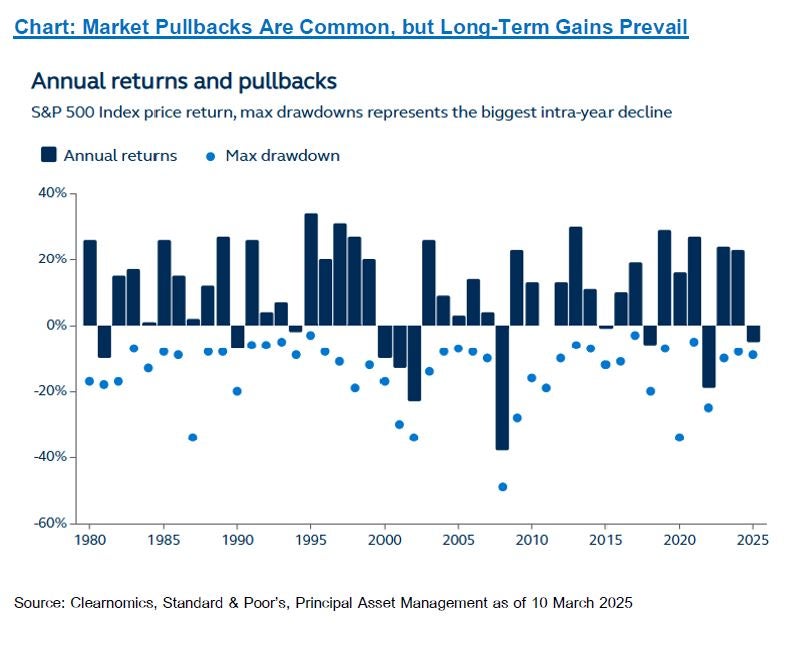

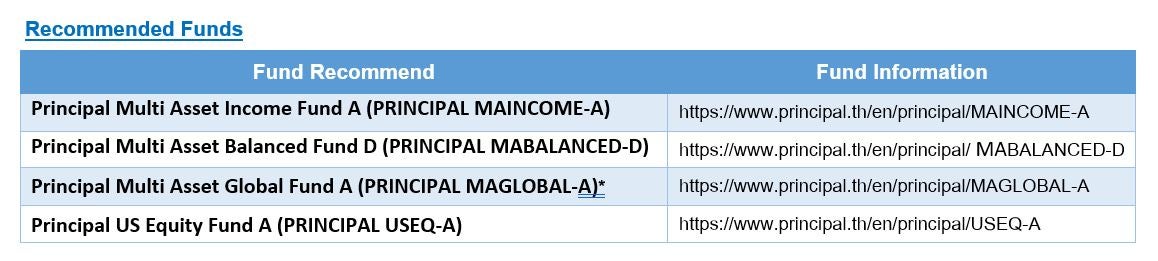

We prefer neutral on risk assets to reflect our cautiousness. Our view is that the potential tariffs throughout the year are possibly a very significant threat and could present damaging disruption to the global economy if they are enacted. However, while the recession risk for the U.S. has risen recently, the economic outlook remains on an expansion trajectory, with monetary policy still in an accommodative stage within the cycle, even though we may see some rate pauses alternating with some cuts. This means that our range of multi asset funds are the appropriate investment choices for this year as we ride out the volatilities in the markets that will continue to be rocked by on-and-off tariff threats. Funds that we recommend are 1) Principal Multi Asset Income Fund (PRINCIPAL MAINCOME); 2) Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED); and 3) Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL). Furthermore, we are cautiously optimistic on U.S. equities, as we believe that Trump’s policies will be more damaging to U.S. trading partners than to the U.S. itself, which means we also like 4) Principal US Equity Fund (PRINCIPAL USEQ), which will give investors plenty of opportunity to enter this year as we believe that U.S. market corrections throughout the year will be the time to buy into this fund.

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL USEQ has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results. / *PRINCIPAL MAGLOBAL is formally known as PRINCIPAL GMA effective from 10 February 2025 onwards.