CIO View: June 2024

The global market theme since the end of May has been a continuation of the risk rally on the back of a strong US economy and strong earnings report. While the US economy remains resilient by and large, the softer than expected economic data and inflation prints have led to a decline in bond yields, and therefore, a continuation of equity strength during the month of June. The FOMC dot plot accompanying the Fed’s meeting in June showed a change of view among the members with just one rate cut expected in 2024, down from three rate cuts expected in the previous dot plot. Market consensus is currently expecting two rate cuts, which is different from what the Fed’s dot plot shows due to the softer economic data and inflation prints mentioned. Meanwhile, the ECB has broken away from the Fed’s cycle by delivering the first rate cut of 25 basis points. These macro developments, along with strong tech earnings continued to favor US mega caps, which we keep at slight OW, but with caution on the overall equity market asset allocation within the portfolio due to positioning data that we see as increasingly crowded and market valuation that are giving us warning signals. Before we delve more into our valuation concern in the later paragraph below, there are a couple of equity markets worth mentioning.

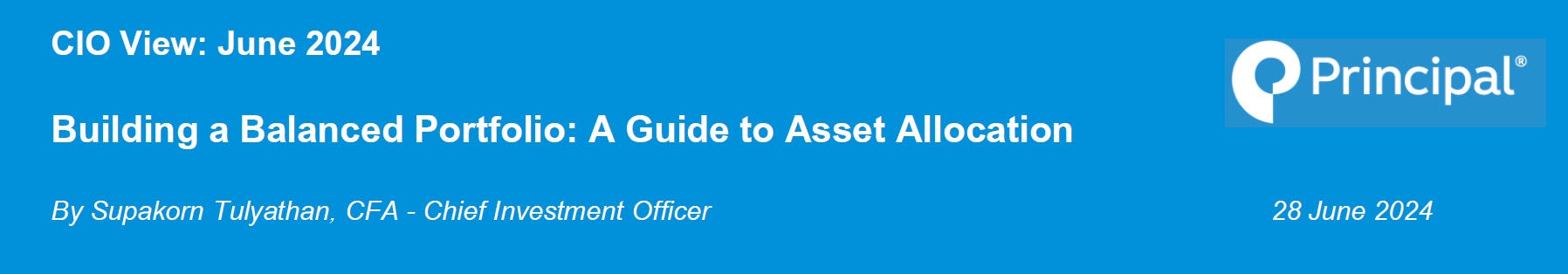

Firstly, the Indian equity market presents a compelling opportunity for investors seeking diversification and high growth potential in 2024. With a strong economy, favorable demographics, and government support, Indian equities are positioned for continued growth. India is projected to be one of the fastest-growing large economies globally in 2024 and 2025, with consensus forecasts of 7.8% GDP growth for 2024 and 7.0% for 2025. The IMF recently published a forecast that India is projected to grow with the average rate of 6.5% over the next five years. This robust economic expansion translates to increased corporate earnings and a positive environment for stock prices. Moreover, India boasts a young and growing population, a significant advantage in the global marketplace. India has 1.42 billion in population, which is expected to grow at the average rate of 0.5% per year. This large workforce fuels domestic consumption, a key driver of economic growth and corporate profitability. The rising disposable income of the Indian middle class creates a strong demand for consumer goods and services. Investing in sectors like FMCG, consumer durables, and retail can benefit from this trend. With the recent election in India completed, Narendra Modi and his coalition had been confirmed to stay in power; thereby, ensuring the continuation of his policy focus on infrastructure development, manufacturing, and job creation. The Indian government's focus on infrastructure development, manufacturing expansion through schemes like the Production Linked Incentive (PLI), and digitalization efforts bode well for long-term economic growth. These initiatives will create new investment opportunities and benefit sectors like industrials, technology, and infrastructure. Also, with the digital transformation underway in India, coupled with rising healthcare needs, this also presents opportunities in technology hardware, equipment, and healthcare equipment sectors. Compared to some developed markets, Indian equities may offer attractive valuations. With market index like the SENSEX having rallied by 10% in the year-to-date, it looks like the market is correctly reflecting all these positive factors to the Indian economy that we have mentioned. While valuations have risen with forward PE ratio trading at around 20 times or around 0.6 standard deviation for its 5-year mean, its strong earnings growth projection at 9.3% for 2024 and 15.13% for 2025 is expected to support the market valuation at this level going forward. Adding Indian equities to your portfolio offers diversification away from developed markets, potentially reducing overall portfolio risk. India's economy has a lower correlation with some developed economies, providing a hedge against global market fluctuations.

Secondly, the Korean equity market offers a blend of potential growth and value in 2024. While some geopolitical risks are present, the anticipated economic recovery, strong semiconductor industry, and attractive valuations make Korea a compelling investment option for investors seeking diversification within Asia. After a challenging 2023, analysts expect a rebound in Korean economic growth for 2024. Consensus is expecting Korea is projected to grow at 2.5% in 2024 and 2.1% in 2025, after a 1.4% growth in 2023, with the IMF making a forecast for Korea to grow at an average rate of 2.2% over the next five years. Korea is a global leader in semiconductor manufacturing, a sector crucial for technological advancements. An anticipated upturn in the global semiconductor market in the second half of 2024 could significantly boost Korean exports and corporate profits in related industries. As the demand for chips continues to rise, Korean tech companies are well-positioned to benefit, driving the overall market performance. Korea is a global leader in the semiconductor industry, with giants like Samsung and SK Hynix dominating the market. Strong earnings from these two companies are expected to support Korean equities overall market earnings, with earnings for 2024 projected to grow at 48.23% and earnings for 2025 projected to grow at 27.29%. Strong market earnings are expected to support overall market rerating for Korea, with current forward PE ratio at 10 times or the equivalent of -1 standard deviation indicating an attractive value proposition at this level.

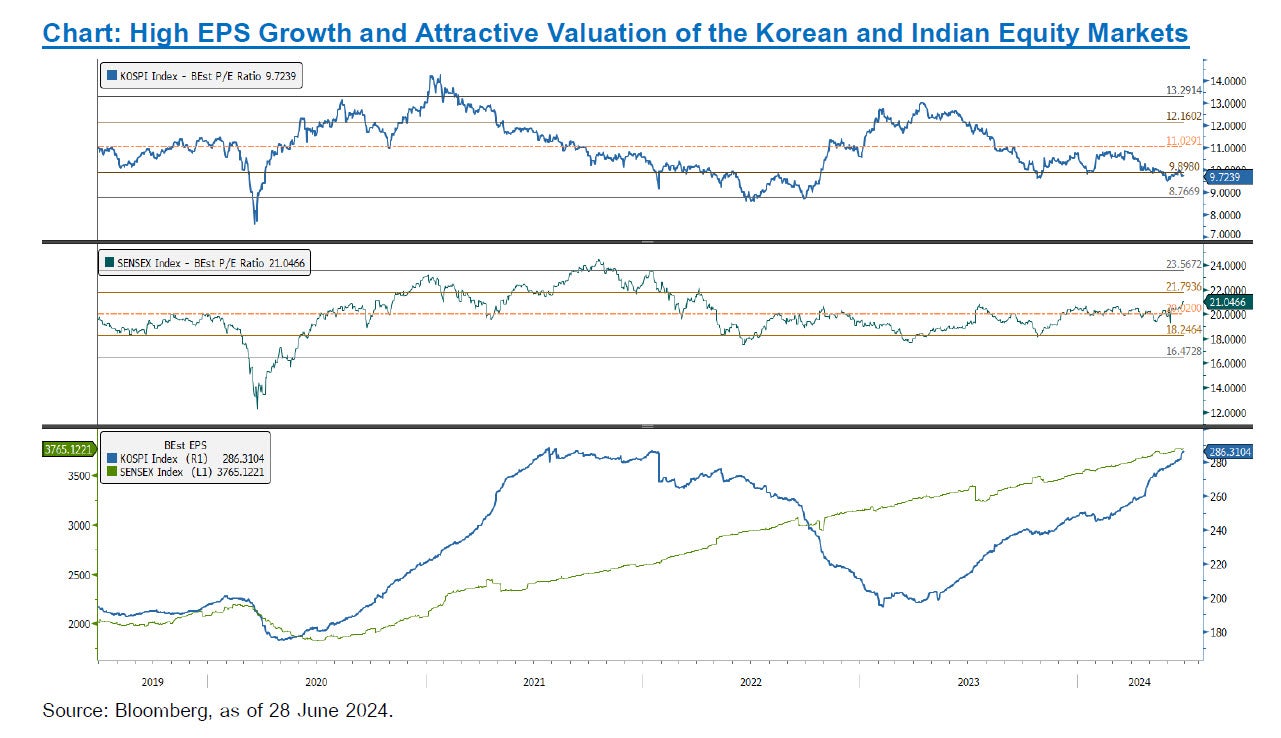

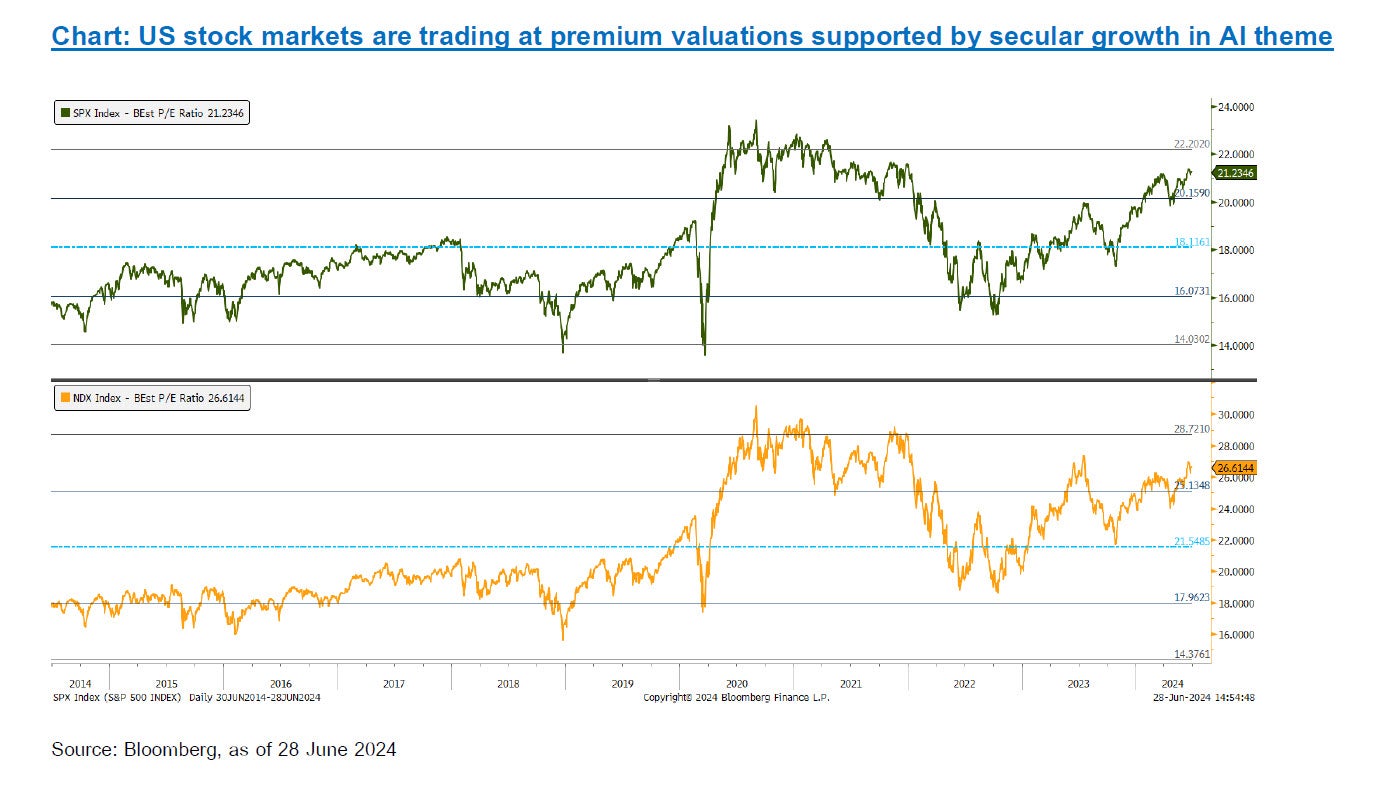

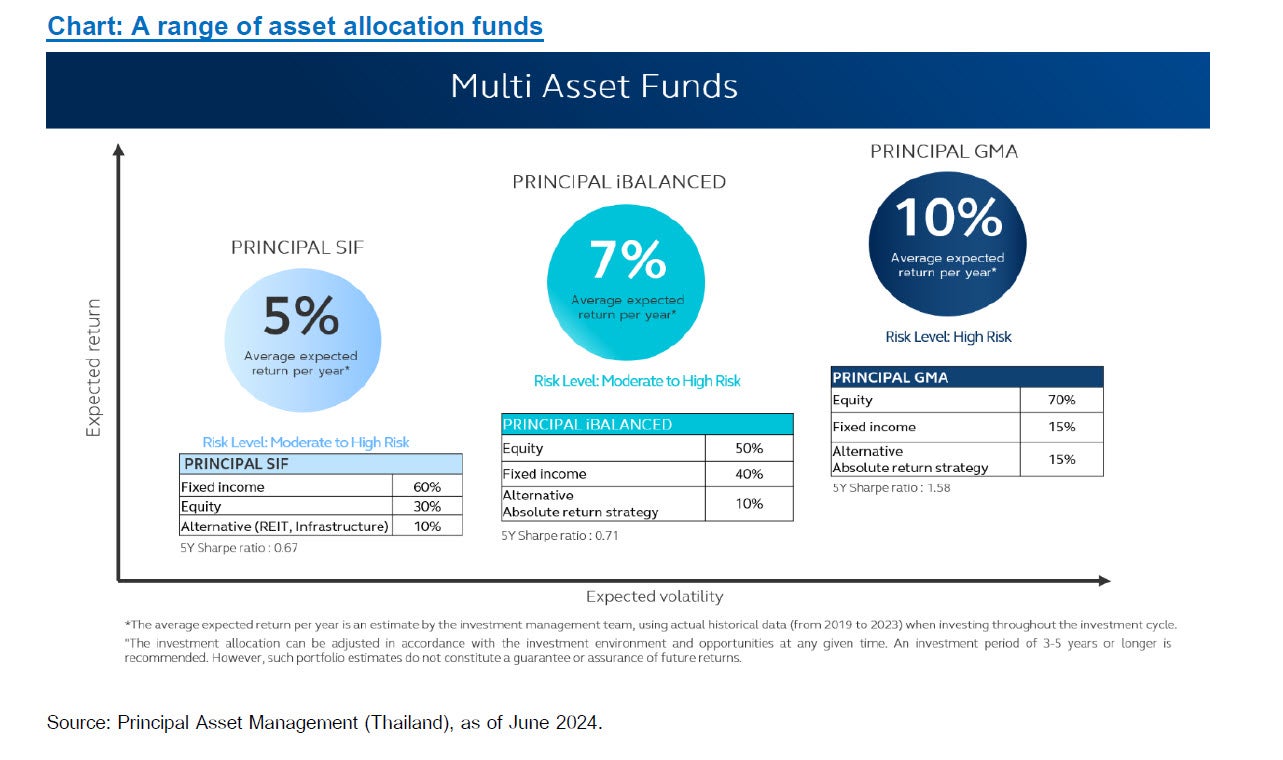

Meanwhile, even though our slight OW position in US equities is maintained, expensive valuation and technical are making us cautious. Firstly, the forward PE ratio for US equities is trading at 21 times for the S&P 500 Index, which is trading at 1.6 standard deviation over the 10-year historical range. Even more extreme, the forward PE ratio for Nasdaq 100 Index is trading at 27 times, which translates to 1.4 standard deviation over the 10-year historical range. The US equity market has been propelled by the Information Technology and the Communication Services sector in the YTD. This, together with our recent observation of a disconnect between the market performance that continues to go up and the percentage of stocks trading above the 200-day moving average that continues to go down, suggests a market that is becoming increasingly fragile and prone to some correcting down the road. And as we move toward the presidential debates, election risks in the US will increasingly come into focus, which may have the potential to disrupt the positive momentum seen in the global equity markets in the YTD. This has prompted us to express our cautious stance via a set of asset allocation recommendations instead. With the US market comprising over 64% of the global market equity, we thus see the need to stay cautious with regards to the overall equity composition within the portfolio, while the high level of bond yields should provide the portfolio with a source of attractive and stable income if unforeseen risks were to cause volatility spikes in the equity markets. At Principal, we provide a range of asset allocation funds that offer equity exposure spanning from conservative to a little more aggressive tilt. For the conservative equity weight in the portfolio, our Principal Strategic Income Fund (PRINCIPAL SIF) offers a choice of investment for those who prefer stability over growth in the portfolio, as the fund is broadly targeted to have 60% in income producing assets such as fixed income and 40% in growth assets such as equities. Our Principal Balanced Income Fund (PRINCIPAL iBalanced) offers a more balanced choice of asset allocation, as the fund is broadly targeted to have 50% in income producing assets such as fixed income and absolute return funds and 50% in growth assets such as equities. Lastly, our Principal Global Multi Asset Fund (PRINCIPAL GMA) offers a choice for those who prefer growth over stability in the portfolio, as the fund is broadly targeted to have just 30% in income producing assets such as fixed income and absolute return funds and 70% in growth producing assets such as equities. These three funds offer the perfect choice to diversify away from an extreme concentrated equity portfolio that many people are currently exposed to. We continue to recommend clients to invest across a broad exposure of asset classes such as fixed income, equities, REITs, commodities, listed private assets, and absolute return strategies, in order to achieve adequate level of diversification for their portfolio.

Recommended Fund

กองทุนที่แนะนำ | ข้อมูลกองทุน |

| Principal Asia Pacific Dynamic Income Equity Fund A (PRINCIPAL APDI-A) | |

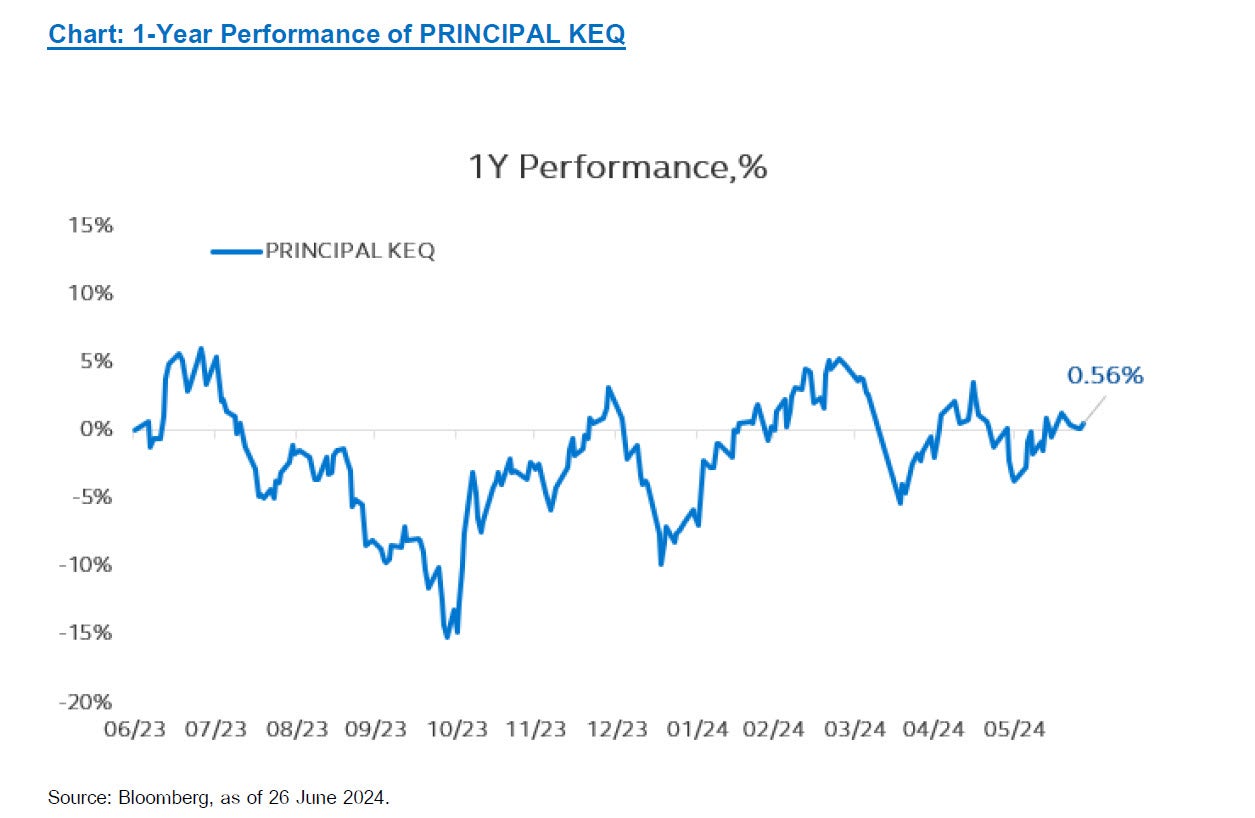

Principal Korea Equity Fund (PRINCIPAL KEQ) | |

Principal Strategic Income Fund A (PRINCIPAL SIF-A) | |

Principal Balanced Income D (PRINCIPAL iBALANCED-D) | |

Principal Global Multi Asset Fund A (PRINCIPAL GMA-A) |

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / PRINCIPAL APDI’s master fund has highly concentrated investment in Hong Kong. So, investors have to diversify investment for their portfolios. / PRINCIPAL KEQ’s master fund has highly concentrated investment in South Korea. So, investors have to diversify investment for their portfolios. / PRINCIPAL GMA has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains / or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.