CIO View: July 2567

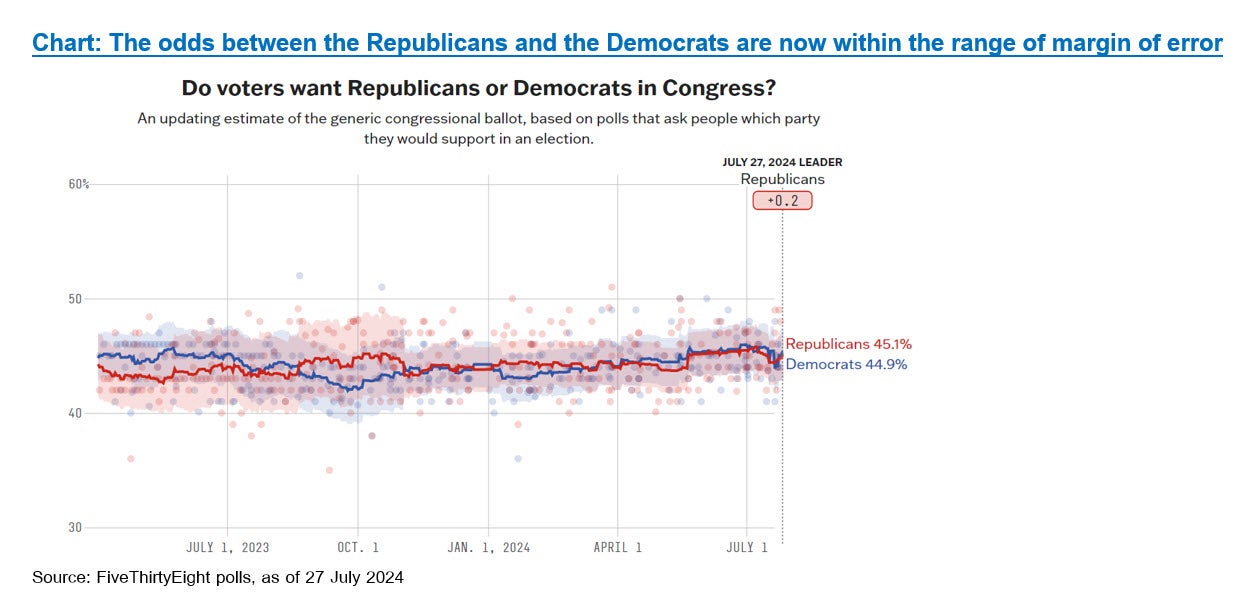

US President Joe Biden dropped out of the 2024 US presidential race for the White House, ending his bid for reelection after a disastrous debate with former US President Donald Trump that raised doubts about the incumbent’s physical and mental fitness for office. The Democrats quickly moved to support Kamala Harris - the current Vice President - to become the Democratic party’s nominee for president. From a procedural standpoint, a candidate must secure 1,986 delegates to become the nominee. It appears increasingly likely that Kamala Harris will achieve this, as potential contenders are now pledging their support to her. After the first debate between the candidates, it became increasingly likely that Donald Trump was going to become the next US president. It now looks like the entrance of Kamala Harris has reset the election outlook, boosting the chances of the Democrats at winning the election, with recent market polls (as shown in FiveThirtyEight.com) showing the odds between the Republicans and the Democrats are now within the range of margin of error, which means it is effectively a tie by some of the recent polls conducted.

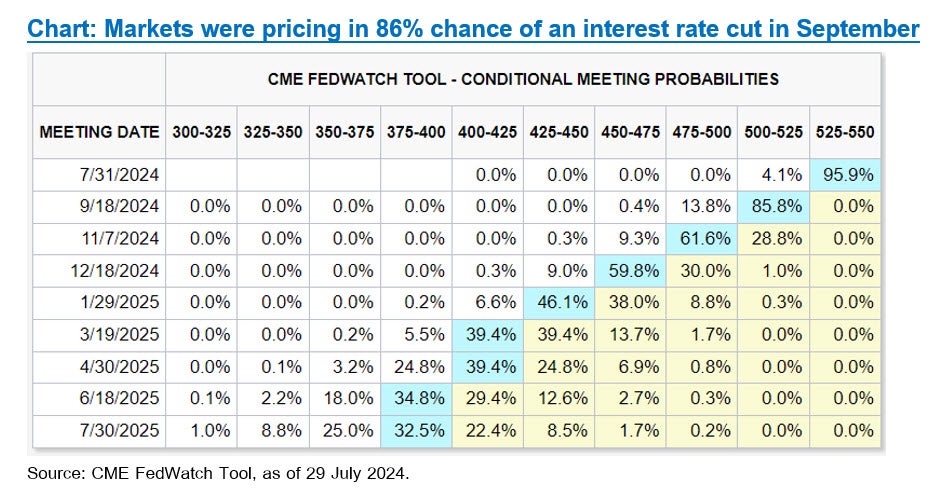

At the time of the release of this month’s CIO View publication, all eyes will be focused on the FOMC meeting conducted between 30 to 31 July. While we don’t expect the Fed to begin their rate cut at this meeting, the recent trend of inflation data releases coming below expectations should get the Fed Chair to indicate in the post-meeting statement something along the lines of “recent data are giving them somewhat greater confidence that inflation is on the right path.” If the tone from the post-meeting statement comes out like we expect, then this will give further boost to the odds of September rate cut, which currently stands at 88%, while the scenario of a total of three cuts within this year could also get boosted by the market. This will also mean that long-duration trades will stay supported further till year-end, and both the IG and HY markets will also stay supported.

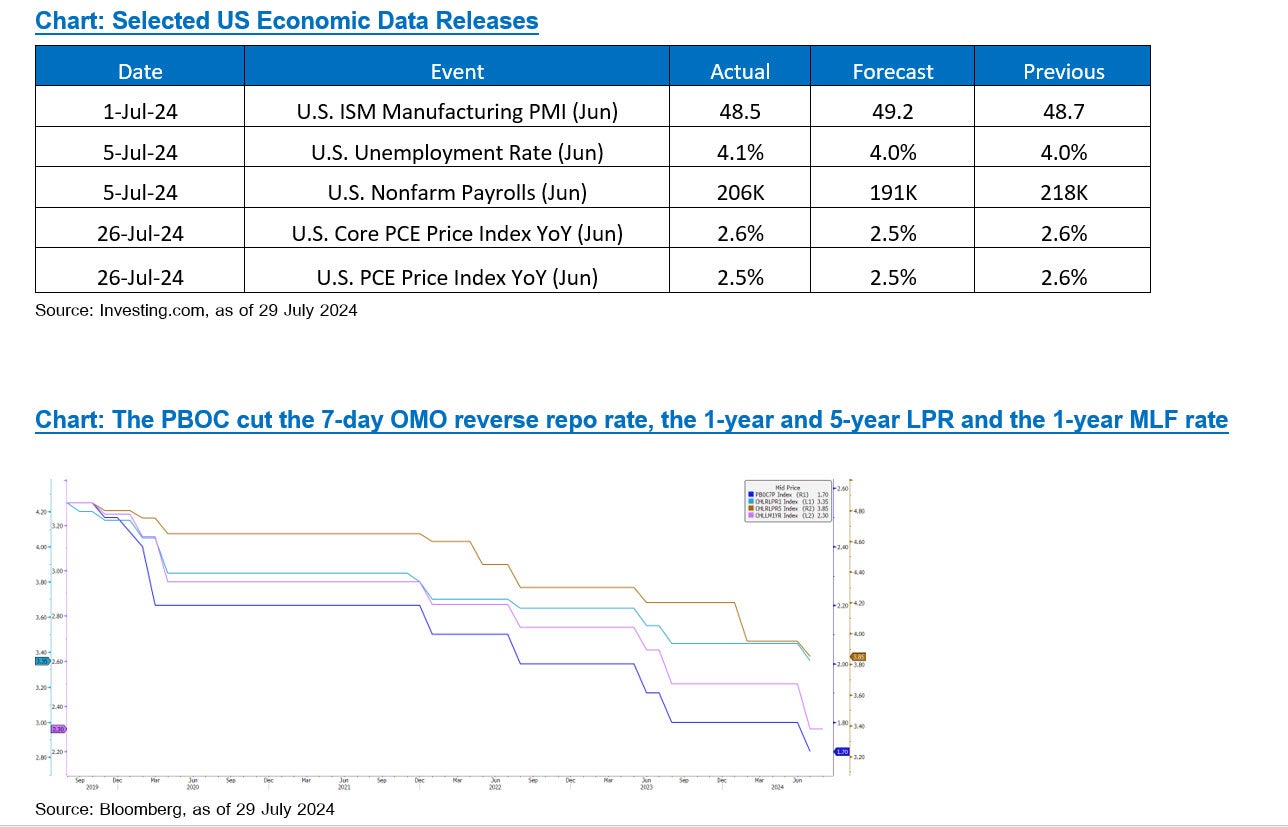

Meanwhile, on the other side of the Pacific Ocean, the PBOC cut the 7-day OMO reverse repo rate by 10bp from 1.8% to 1.7% on 22 July, followed by a 10bp cut for both the 1-year and 5-year LPR. Following closely on the heels of this surprise move, the PBOC announced another surprise move to cut the 1-year MLF rate by 20bp with RMB200bn liquidity injection on 25 July. Usually, the OMO and LPR rates are the more important monetary policy tools, but the additional MLF rate cut announcement does serve as a complementary signal to us that the policymakers are getting more and more serious about the weak domestic demand situation, which points to more easing to come later this year.

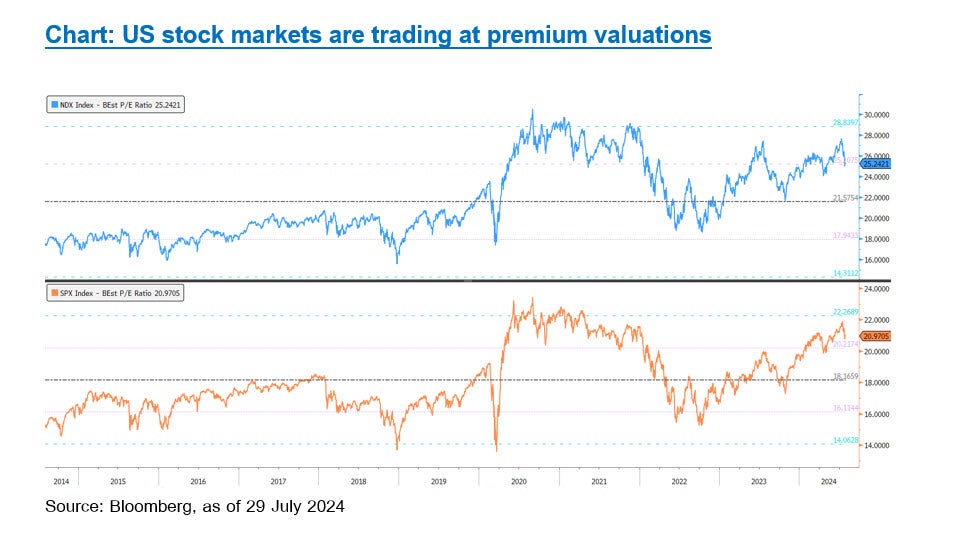

Perhaps the most interesting bits in the market over the past month was the correction in the market, especially the big tech sector that saw a -9% correction over the course of 10 to 25 July. This was probably related to the market hypothesis that we have been putting out there through our publication for a couple of months now that the equity market had been increasingly facing risk of correction. Although we have observed that the 1Q24 reporting season has seen most companies beating estimates, much of the earnings surprises have been concentrated in the Magnificent Seven group. Unsurprisingly, with the market that was trading at all-time high and expensive valuation of the Magnificent Seven, earnings beats were not as rewarded by the market, and earnings misses were treated severely, which is what we think happened to the market’s recent correction.

Our cautious stance towards holding a very large concentrated equity portfolio still apply, and we believe that a set of right asset allocation funds provide the perfect solution for the very complicated global markets that we’re facing. At Principal, we provide a range of asset allocation funds that offer equity exposure spanning from conservative to a little more aggressive tilt. For the conservative equity weight in the portfolio, our Principal Strategic Income Fund (PRINCIPAL SIF) offers a choice of investment for those who prefer stability over growth in the portfolio, as the fund is broadly targeted to have 60% in income producing assets such as fixed income and 40% in growth assets such as equities. Our Principal Balanced Income Fund (PRINCIPAL iBALANCED) offers a more balanced choice of asset allocation, as the fund is broadly targeted to have 50% in income producing assets such as fixed income and absolute return funds and 50% in growth assets such as equities. Lastly, our Principal Global Multi Asset Fund (PRINCIPAL GMA) offers a choice for those who prefer growth over stability in the portfolio, as the fund is broadly targeted to have just 30% in income producing assets such as fixed income and absolute return funds and 70% in growth producing assets such as equities. These three funds offer the perfect choice to diversify away from an extreme concentrated equity portfolio that many people are currently exposed to. We continue to recommend clients to invest across a broad exposure of asset classes such as fixed income, equities, REITs, commodities, listed private assets, and absolute return strategies, in order to achieve adequate level of diversification for their portfolio.

Recommended Fund

Fund Recommend | Fund Information |

| Principal Strategic Income Fund A (PRINCIPAL SIF-A) | |

| Principal Balanced Income D (PRINCIPAL iBALANCED-D) | https://www.principal.th/en/principal/ iBALANCED-D |

| Principal Global Multi Asset Fund A (PRINCIPAL GMA-A) |

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL GMA has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains / or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results.