CIO View: January 2025

On January 20, former U.S. President Donald Trump announced a major and unprecedented shift in North American trade policy during an Oval Office signing ceremony, where he revealed plans to impose a significant 25% tariff on imports from Mexico and Canada, starting February 1, which is expected to raise serious concerns about the outlook for U.S. inflation and disrupt the stability of regional trade relations. While Trump had previously proposed broad tariffs of up to 20% on imports from all countries during his candidacy, with a higher 25% tax on goods from Mexico and Canada, this specific executive order places a focused emphasis on investigating the causes of America’s trade deficits, identifying unfair trade practices, and reviewing existing agreements, including the US-Mexico-Canada trade agreement (or better known as USMCA), to evaluate their impact on U.S. workers and businesses, and whether America should remain in the USMCA free trade agreement, while also exploring measures to curb the flow of fentanyl and undocumented migrants into the U.S.

Despite Trump’s assurances that foreign countries will absorb the cost of these tariffs rather than American consumers, research from the Peterson Institute for International Economics strongly indicates otherwise, with findings suggesting that the aggressive tariff policy could force American households to pay higher prices for a wide array of goods, ranging from everyday necessities like food and toys to higher-value items such as electronics and apparel. Mexico and Canada are two of America’s top three trade partners (the third being China). Last year, the US imported $475 billion worth of goods from Mexico and $418 billion from Canada, collectively accounting for 30% of the value of all the goods the US imported last year. Meanwhile, the US exported $354 billion worth of goods to Canada last year and $322 billion to Mexico, accounting for a third of the value of all goods the US exported worldwide last year. As Mexico and Canada collectively account for 30% of the value of U.S. imports, trade tariff imposed could intensify pressure on domestic businesses, particularly those heavily reliant on importing electronics, chemicals, and transportation equipment. On the other hand, as US export to the two countries also account for a third of total export value, the risk of these trading partners imposing retaliatory tariffs could also affect US exporters especially Automotive Industry and Agriculture products sector. In our view, such sweeping tariffs could represent a major trade shock that might disrupt not only North America’s economic stability but also have far-reaching consequences for the global economy, as they dampen business sentiment and disrupt global supply chains; therefore, while we still believe that these are more of a threat used by Trump to negotiate his other strategic objectives, the risks that they could happen need to be monitored closely.

On another note, U.S. tech stocks faced a sharp decline on January 27, triggered by a surprising announcement from Chinese artificial intelligence startup company DeepSeek, which revealed a new AI model named R1 that reportedly offers ChatGPT-like capabilities while operating at a fraction of the cost incurred by its U.S. counterparts, such as OpenAI, Google, and Meta, significantly challenging the perception of dominance previously held by major U.S. tech firms. Although some analysts have expressed skepticism regarding the sustainability of DeepSeek's cost advantage, particularly when scaling its technology to higher-end models, the news has nonetheless raised doubts about the high valuations of established U.S. tech leaders, highlighting the importance for investors to consider diversification to mitigate potential risks in the sector.

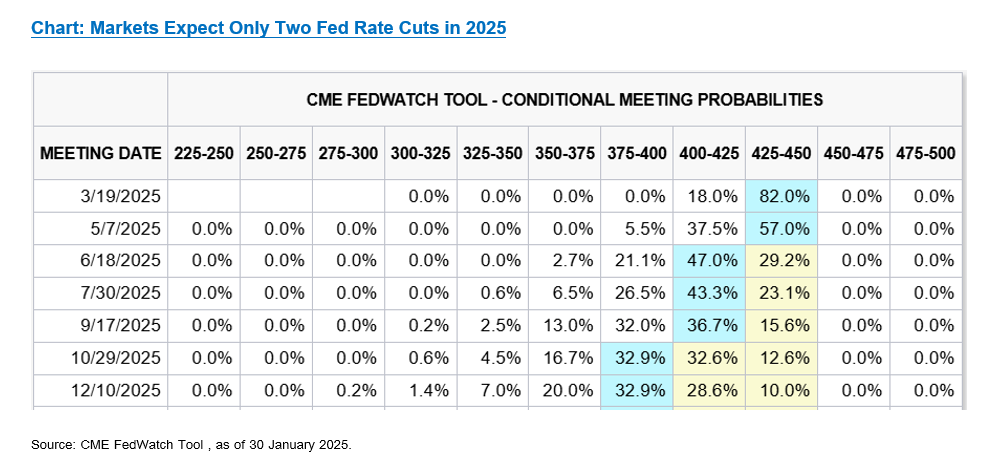

In the monetary policy sphere, central bank meetings will dominate the global economic calendar from late January through early February, with most monetary authorities expected to continue easing policies, although Brazil and Japan remain exceptions as they maintain a tightening stance. Fed Chair Jerome Powell signaled that the U.S. central bank had reached a pause mode, as the Federal Reserve decided to keep its policy rate on hold at the 4.25% to 4.50% target range. The Fed Chair said the U.S. central bank was “seeing the economy move towards 2% inflation and has moved largely to maximum employment.” And that the policy stance is very well calibrated to balance the two goals of the Fed between employment and inflation. He also said that the Fed is “meaningfully above” the neutral rate, and that the Fed will not be in a hurry to make further adjustments. Meanwhile, just shortly after the Fed’s rate decision, U.S. President Donald Trump criticized the Fed for failing to control inflation. The Fed’s unanimous decision to keep rates on hold followed increased political pressure from Trump who spoke out publicly that borrowing costs should fall a lot and vowed to let it be known if he disagreed with the central bank’s decision. Jerome Powell did not react to Trump’s calls to significantly cut rates, saying that he was not going to have any response or comment on what the president said, and that there had been no contact between him and the White House since the new president took office.

The European Central Bank (ECB) cut interest rate to 2.75% from 3.00% on January 30, widening the difference with the Fed’s policy rate, and making this already the fifth cut in its rate cut cycle. The decision to cut 25 basis points was unanimous, following the release of Eurozone GDP in Q4 that show the Eurozone economy had no growth in the last quarter of the year. ECB President Christine Lagarde said that the policy rate remains restrictive, hinting that interest rates are still higher than the neutral rate, signaling that the ECB still have more room to cut rates several more times. Lagarde warned that economic growth could turn out weaker than expected amid possible global trade frictions and geopolitical tensions.

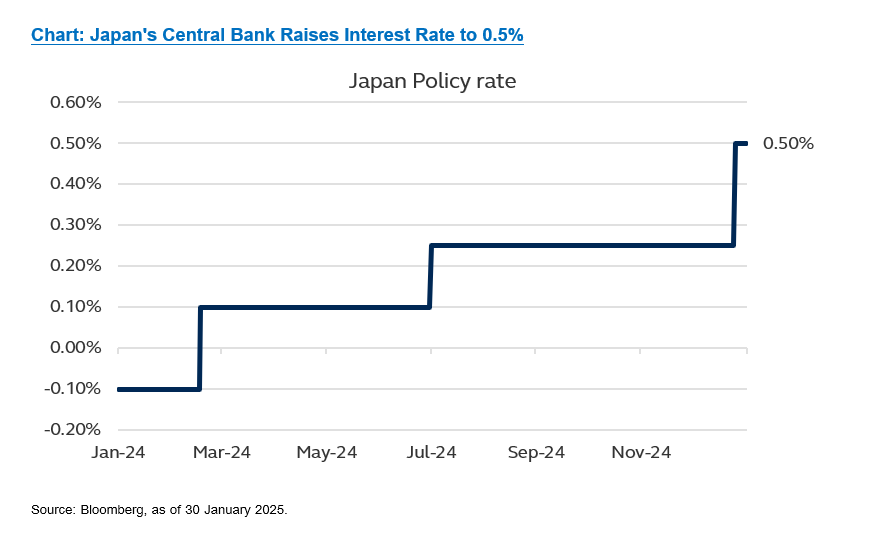

In Japan, the Bank of Japan (BOJ) raised its policy rate by 25 basis points to 0.5% during its meeting on January 24, marking a widely anticipated decision that came alongside a significant update to the central bank’s inflation forecasts, which now project core inflation to remain above 2% through FY2025, indicating a shift toward a more sustained period of higher price pressures. Despite this policy shift, the BOJ emphasized its commitment to maintaining an accommodative stance, highlighting that real interest rates remain deeply negative, and further monetary tightening will depend on ongoing evaluations of the economy, inflation trends, and broader financial conditions, with market consensus expecting no additional hikes until the latter half of 2025.

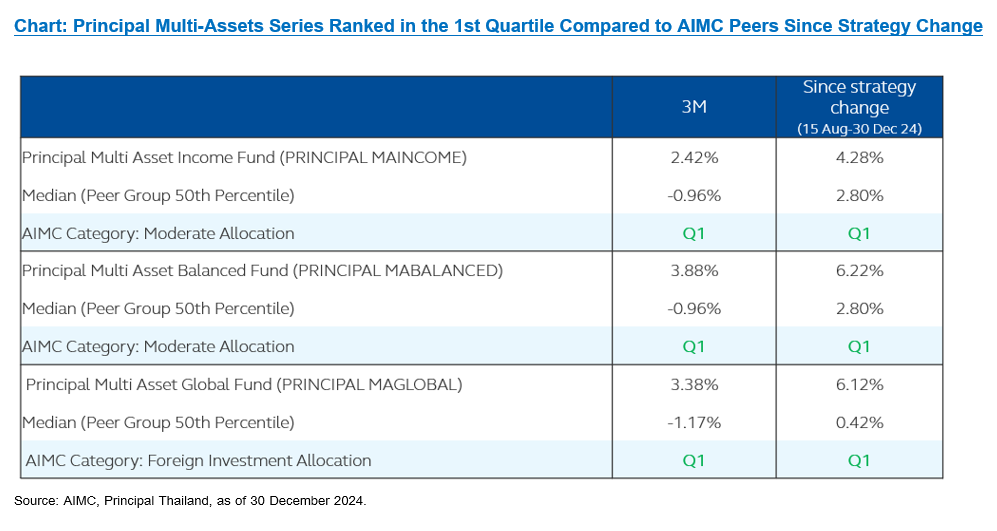

Our view is that the potential tariffs throughout the year are possibly a very significant threat and could present damaging disruption to the global economy if they are enacted. However, the U.S. economic outlook remains on an expansion trajectory, with monetary policy still in an accommodative stage within the cycle, even though we may see some rate pauses along with some cuts. This means that our range of multi asset funds takes the spotlight this year: 1) Principal Multi Asset Income Fund (PRINCIPAL MAINCOME); 2) Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED); and 3) Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL). Furthermore, we are positive on U.S. equities, as we believe that Trump’s policies will be more damaging to U.S. trading partners than to the U.S. itself, which means we also like 4) Principal US Equity Fund (PRINCIPAL USEQ), which will give investors plenty of opportunity to enter this year as we believe that U.S. market corrections throughout the year will be the time to buy into this fund.

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL USEQ has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results. / *PRINCIPAL MAGLOBAL is formally known as PRINCIPAL GMA effective from 10 February 2025 onwards.