CIO View: February 2025

Most recently, the Bureau of Economic Analysis (BEA) released the second estimate of the fourth quarter US GDP, showing that the US economy grew at 2.3% annualized pace from the previous quarter, which was unchanged from the advanced estimate. However, the 2.3% growth rate shown in the fourth quarter was lower than the 3.1% pace recorded for the third quarter of last year, and 3.0% pace recorded for the second quarter. The increase in real GDP in the fourth quarter reflected increases in consumer and government spending that were partly offset by a decrease in investment, according to the BEA.

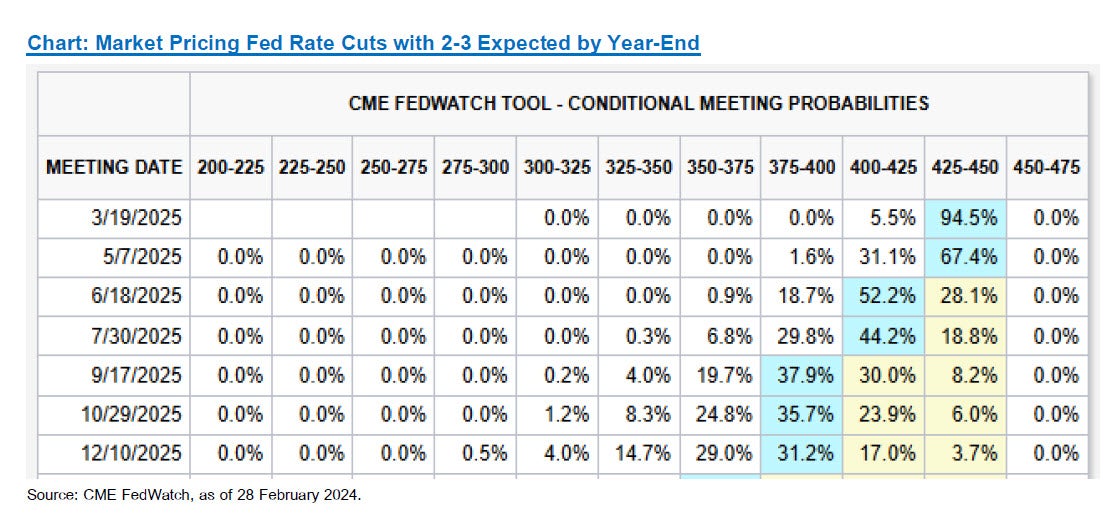

Back in January, the Fed held interest rate steady at 4.25%-4.50% in a widely expected by the market. The decision followed three consecutive cuts since September 2024 that had seen the Fed funds rate cut by a total of 100 basis points. The post-meeting statement only offered a few hints behind the decision to hold. It mentioned a more optimistic view on the labor market while losing a key reference from the December statement that inflation has made progress toward the Fed’s 2% inflation goal. Additionally, the statement mentioned that the unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid; while inflation remained somewhat elevated. A stronger labor market and stubborn inflation would provide less incentive for the Fed to ease policy. The statement also indicated that the economy has continued to expand at a solid pace. Powell said that Fed officials are waiting to see what policies are enacted before judging the effect on inflation, employment, and overall economic activity. Currently, the CME FedWatch Tool is showing that the market has priced in around two cuts with a 30% probability, and around three cuts with a 30% probability by the end of this year.

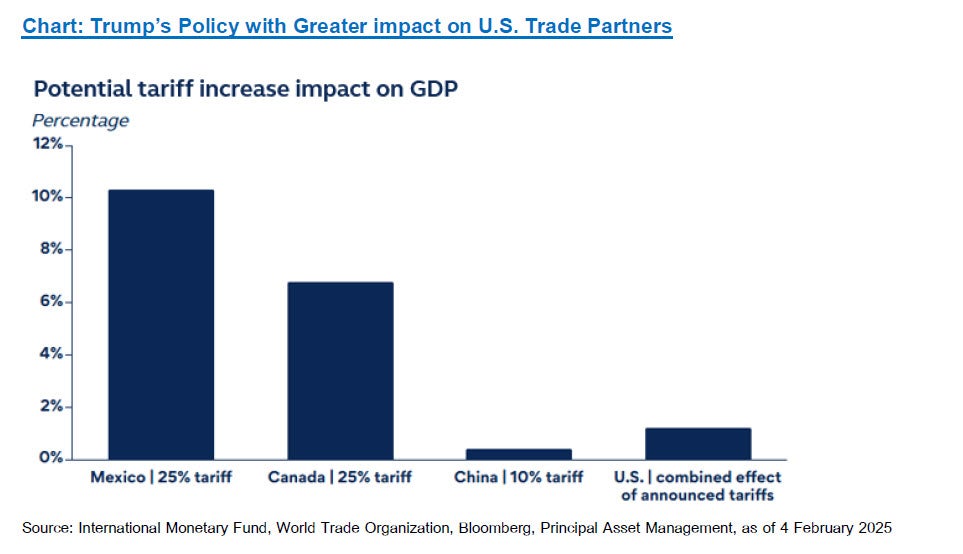

Late in February, US President Donald Trump has said that his proposed 25% tariffs on Mexican and Canadian goods will take effect on March 4 along with an extra 10% duty on Chinese imports, as fentanyl inflows into the US are still too high. Trump said that the fresh tariffs on Chinese imports would stack on top of the 10% tariff that he levied on February 4, resulting in a cumulative 20% tariff. Trump told reporters that he decided to add the extra tariffs on China and stick to the Tuesday deadline for Canada and Mexico given what his administration sees as insufficient progress on curbing fentanyl flows into the country. Trump also imposed additional 25% tariffs on steel and aluminum imports into the U.S. and planned to announce reciprocal duties over what he sees as unfair trading practices.

On the developing story of a brokered deal between the ongoing Russia and Ukraine conflict, the Ukrainian President Volodymyr Zelensky will meet the US President Donald Trump in Washington on Friday, February 28 to sign an agreement on sharing Ukraine’s mineral resources to the US, according to Trump. Zelensky has described the bilateral deal as preliminary, and said he wants further agreements which include US security guarantees to deter renewed Russian aggression. However, Trump seemingly turned down the suggestion, saying that the responsibility should fall to Europe; while he also seemingly ruled out the prospect of Ukraine becoming a Nato member. Zelensky has objected to the idea of a ceasefire between Russia and Ukraine, without a security guarantee in place.

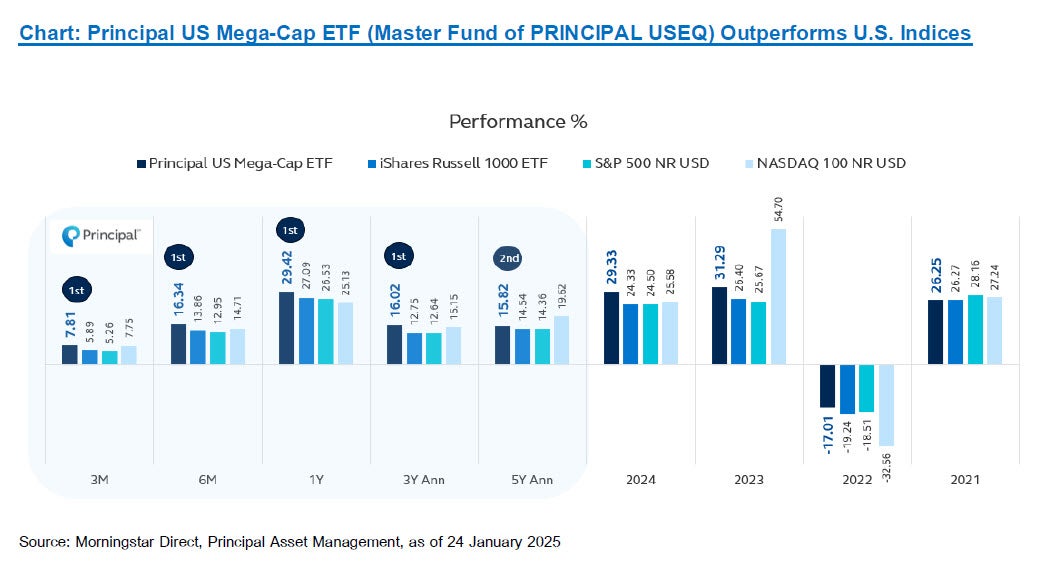

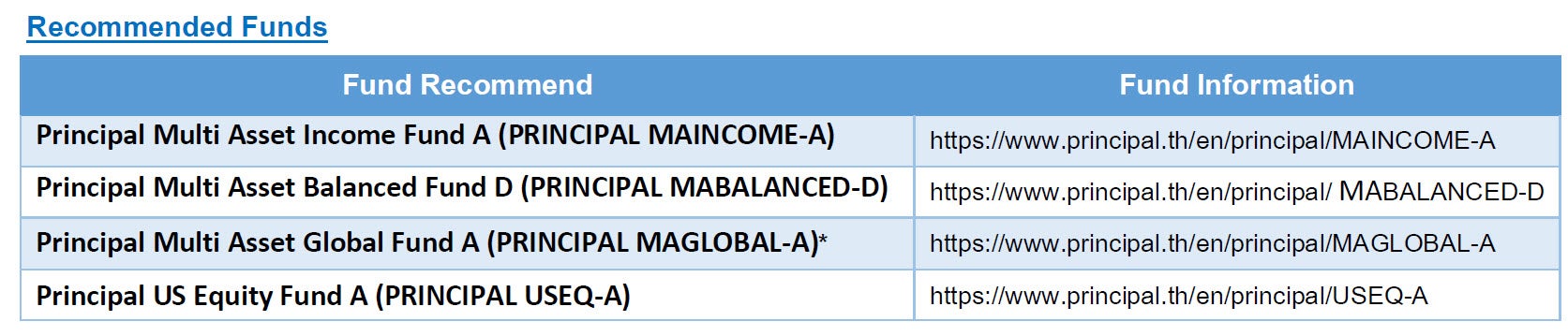

We prefer neutral on risk assets, including equities to reflect our cautiousness. Our view is that the potential tariffs throughout the year are possibly a very significant threat and could present damaging disruption to the global economy if they are enacted. However, the U.S. economic outlook remains on an expansion trajectory, with monetary policy still in an accommodative stage within the cycle, even though we may see some rate pauses along with some cuts. This means that our range of multi asset funds takes the spotlight this year: 1) Principal Multi Asset Income Fund (PRINCIPAL MAINCOME); 2) Principal Multi Asset Balanced Fund (PRINCIPAL MABALANCED); and 3) Principal Multi Asset Global Fund (PRINCIPAL MAGLOBAL). Furthermore, we are positive on U.S. equities, as we believe that Trump’s policies will be more damaging to U.S. trading partners than to the U.S. itself, which means we also like 4) Principal US Equity Fund (PRINCIPAL USEQ), which will give investors plenty of opportunity to enter this year as we believe that U.S. market corrections throughout the year will be the time to buy into this fund.

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL USEQ has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / Past performance does not guarantee future results. / *PRINCIPAL MAGLOBAL is formally known as PRINCIPAL GMA effective from 10 February 2025 onwards.