CIO View: December 2024

Starting with a quick recap of key events in November. Republican presidential candidate Donald Trump had won the US presidential election, besting Kamala Harris from the Democrat. Markets had broadly reacted to the event of a red sweep with a jump in US treasury yields, US dollar, and US stock market during November. Trump has promised that on his first day in office he would impose a 25% tariff on all products from Mexico and Canada, and an additional 10% tariff on goods from China. The Fed reduced its benchmark rate by 25bps, as widely expected, moving its to a new range of 4.50-4.75%. Moody's revised France's outlook to "negative" from "stable” over mounting uncertainty that the country will be able to curb widening budget deficits but maintained its rating on French debt at Aa2. Ukraine has fired UK-supplied Storm Shadow missiles at targets inside Russia for the first time after given permission from Washington. BOJ kept short-term interest rates at 0.25% and maintained its forecast that inflation will hover near its 2% inflation target in coming years. Japanese PM Shigeru Ishiba won a vote in Parliament to carry on as the prime minister and launched a $140 billion economic stimulus package. The package is set to include support for sustained wage gains and cash handouts for low-income households. China unveiled a 10-trillion-yuan debt package to ease local government financing strains. PBOC left lending benchmark rate unchanged. The 1Y-LPR was kept at 3.1%, and the 5Y-LPR was unchanged at 3.6%.

During December, the Federal Reserve recently lowered its benchmark interest rate by a quarter of a percentage point, bringing it to a range of 4.25% to 4.50%. This was a third consecutive reduction following from a 50bp cut in September and a 25bp cut in November, bringing the policy rate back to where it was in December 2022 when rates were on the move higher. However, the Fed has indicated that future interest rate cuts will be more gradual than previously anticipated. They now foresee only two rate cuts in 2025, down from the four cuts projected earlier in September. This shift in stance stems from concerns that inflation remains stubbornly high. Despite macro data to the contrary, a Fed report earlier this month noted that economic growth had only risen “slightly” in recent weeks, with signs of inflation waning and hiring slowing. Moreover, the Fed will have to deal with the impact of fiscal policy under President-elect Donald Trump, who has indicated plans for tariffs, tax cuts, and mass deportations, that could all be inflationary. This more cautious outlook from the Fed has rattled global equity markets. Following a significant rally since the US presidential election in November, stock markets experienced a downturn. Investors reacted negatively to Fed Chair Jerome Powell’s more conservative tone, who explicitly stated that only two interest rate cuts would occur in 2025, instead of the previously projected four. This change in expectations has also impacted the bond market. The yield on 10-year US Treasury bonds has risen above 4.50%, reaching its highest level in seven months. This increase in yield reflects investor concerns about higher inflation and the potential for the Fed to maintain a tighter monetary policy for longer. Furthermore, the US Dollar has strengthened significantly. The US Dollar index has risen above 108, marking its highest level since 2023. This dollar strength is likely a result of the Fed’s more hawkish stance, which makes US assets more attractive to foreign investors.

On a separate note, the US Senate gave final passage to a bill to keep the government funded for three more months. The White House said that President Biden would sign the bill and avoid forcing US troops, Border Patrol agents, air traffic controllers and millions of other federal workers to work without pay. The package funds the government at current levels through 14 March 2025, and includes $100 billion in disaster aid and a 1-year farm bill – while stripping out a debt limit extension demanded by President-elect Trump earlier in the week.

For other major central banks of note, the European Central Bank lowered the benchmark interest rate by 25 bps, 4th reduction since June to 3%. The ECB also revised down Eurozone GDP growth to 0.7% in 2024, 1.1% in 2025, 1.4% in 2026 and 1.3% in 2027, while Inflation is expected settle down to average 2.4% in 2024, 2.1% in 2025, 1.9% in 2026, and 2.1% in 2027. Over in Japan, the BOJ kept its short-term policy rate unchanged at 0.25% as policymakers were still cautious on the political uncertainty over US president-elect Donald Trump’s actual economic plans once he formally takes office in January. Over in China, Chinese government agreed to raise the budget deficit to 4% of GDP in 2025 from their previous 3% target this year, while maintaining economic growth target of around 5%. Beijing has also agreed to issue CNY3 trillion worth of special treasury bonds in 2025, sharply increasing from this year’s CNY1 trillion in order to prepare to soften the potential negative impact from the expected increase in US tariffs on Chinese imports.

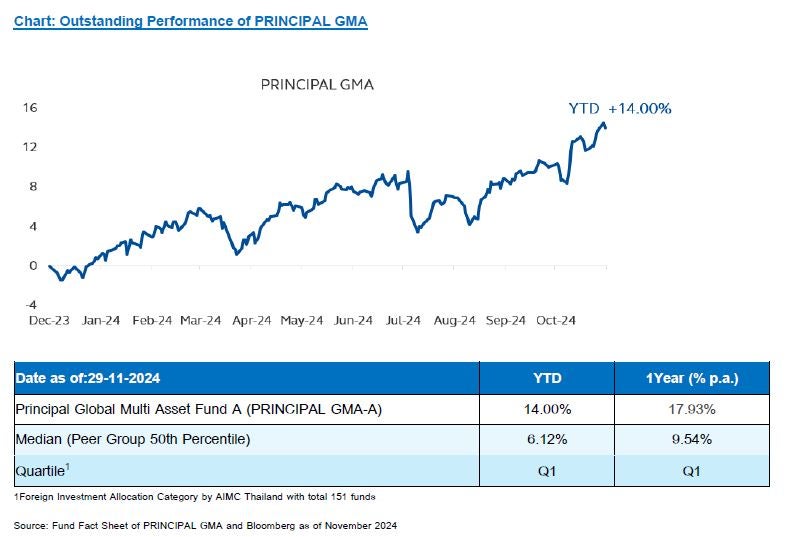

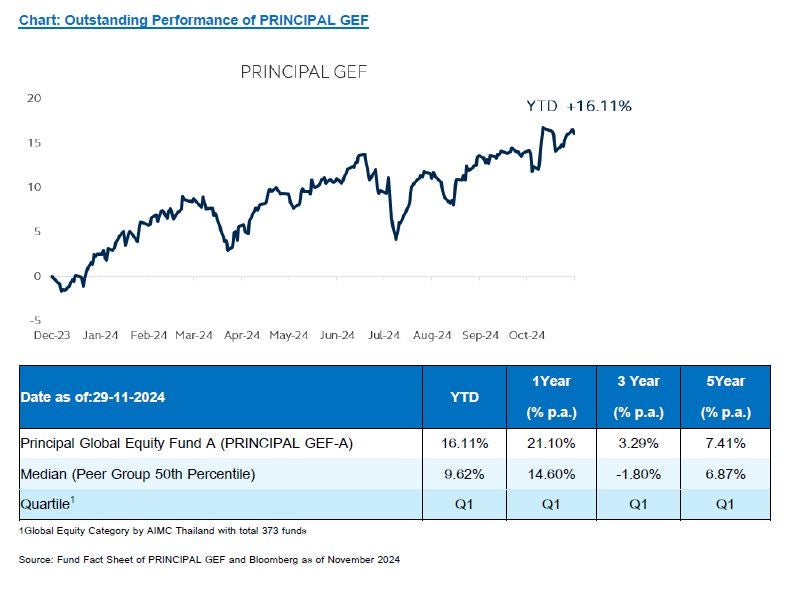

We expect the global economy to grow solidly in 2025, with the US economy expected to grow faster than other developed market countries. This will be supported by Trump’s economic policies such as tax cuts and regulatory easing. So far, data over the past year had shown that inflation has continued to trend downward, and is now within the central bank’s target, while most central banks are in the process of cutting interest rates back to more normal levels. However, the biggest caveat to the sanguine outlook for inflation will come from the potential across-the-board tariff hike if president-elect Donald Trump decided to actually implement them as he had campaigned. This would then cause an increase in inflationary pressure, negatively impact global growth via slower international trades, and then lead to increase in volatility in financial markets. Thus, we expect the bull market in global equities to remain intact during the first half of 2025, led by US equities as Trump’s economic policies favor domestic economy over the rest of the world, while corporates’ earnings growth remains solid, and valuation measures still haven’t reached extreme levels to cause us to turn contrarian. On the other hand, we expect European equities to underperform as the region face headwinds from increasing political and economic growth challenges. We also expect Japanese equities to underperform as the BOJ is expected to continue to raise interest rates gradually, as they are in a different interest rate cycle than the US counterpart due to their inflation upturn. For China and Southeast Asia, the equity markets could continue to underperform as China would be the hardest hit from Trump’s tariff hike, while the Fed’s sharply slower path of rate cuts could potentially lead to stronger levels of the US dollar, which will negatively impact the outlook for EM and Asian assets. This leads us to have a positive outlook for Principal Global Equity Fund (PRINCIPAL GEF) and Principal Global Multi Asset Fund (PRINCIPAL GMA) as a proxy to the continued upward trend in global equities during the first half of 2025. Both funds have a diversified exposure across many countries and sectors, with the difference being PRINCIPAL GEF is a pure equity fund, while PRINCIPAL GMA is a multi-asset fund with relatively higher weights in equities than other multi asset funds with more conservative weights in risk assets. Thus, both choices will allow investors to participate in the upside in equity markets, depending on investors’ preference between a pure equity fund vs a multi-asset fund. PRINCIPAL GEF has a strong track record with its performance being ranked in the 1st quartile ranking among the global equity fund peers in Thailand in 2024’s YTD, and across the 1-year, 3-year and 5-year periods. PRINCIPAL GMA also boasts a strong track record with its performance being in the 1st quartile ranking in the foreign investment allocation fund peers in Thailand in 2024’s YTD, and over the 1-year period (due to its more recent inception date in March 2022)

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./ PRINCIPAL GMA and PRINCIPAL GEF have highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / PRINCIPAL GMA may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment./ PRINCIPAL GEF has a policy to invest in foreign countries, the fund may have exchange rate risk. Investors may lose or receive foreign exchange gains / or receive a lower return than the initial investment. However, the Fund will hedge the exchange rate risk not less than 90% of the value of the invested asset./ Past performance does not guarantee future results.