Stay defensive into FOMC and US election

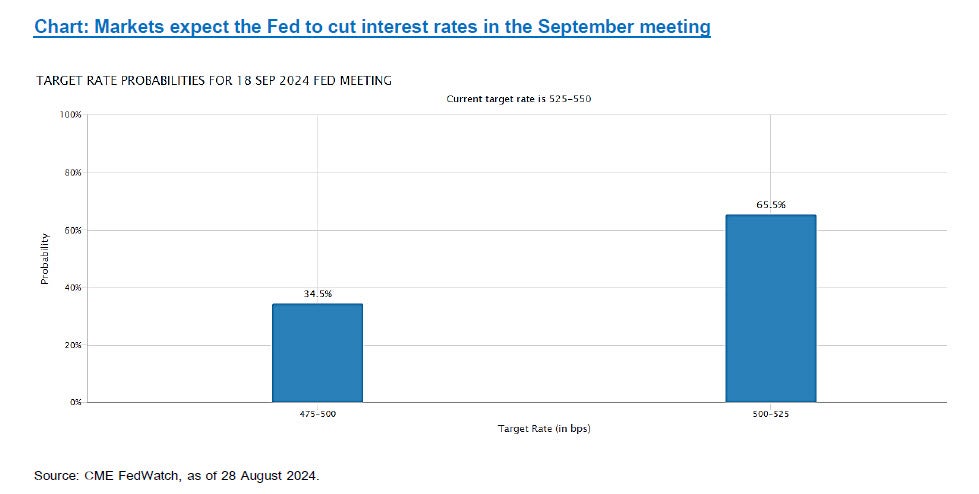

At this year’s keynote address at the Fed’s annual retreat in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell laid the groundwork for future rate cuts that markets have been widely expecting to begin in September. He noted the progress on inflation and said the Fed can now turn its focus to make sure the economy stays around full employment. He said that inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized, and the balance of the risks to the two mandates has changed. He vowed to do everything they can to make sure the labor market stays strong and progress on inflation continues. During parts of July and August, concerns about recession risk in the US had risen sharply, triggering correction in global equity markets. The unemployment rate has consistently climbed higher to 4.3%, which is a pace of change that would historically signal an imminent recession, according to an economic hypothesis known as the Sahm Rule. However, Powell has attributed the rise in unemployment to more individuals entering the workforce and a slower pace of hiring, rather than a rise in layoffs or a general deterioration in the labor market. Markets are now expecting the Fed to start cutting in September, though Powell didn’t mention exact timing of when he thinks rate cuts will begin.

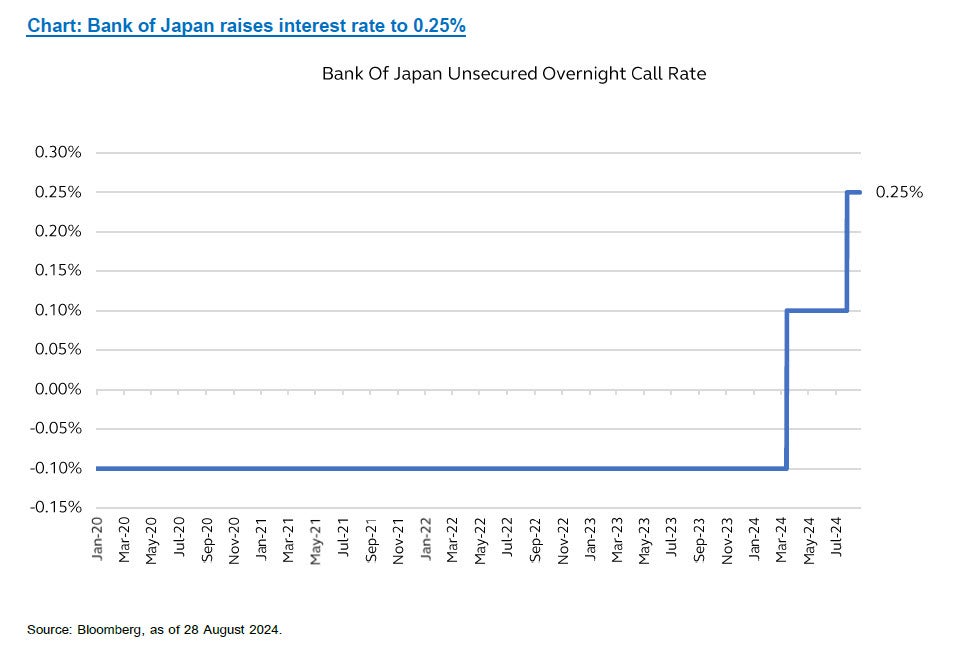

Bank of Japan has raised its policy interest rate to 0.25% and outlined plans to reduce its monthly bond purchases in order to tighten its monetary policy. This was the highest level of its policy interest rate since the global financial crisis in 2008, from a previous range of 0% to 0.1%. BOJ’s rate hike decision was made based on economic and inflation conditions that remained on track. However, Governor Kazuo Ueda also acknowledged that upside risks to inflation caused by the weak Japanese yen were also a factor in the decision to hike. Most recently, Governor Ueda reaffirmed his resolve to raise interest rates if inflation stayed on course to sustainably hit the 2% target. According to the Governor, the sharp market volatility seen in early August was due to rising fears of a US recession, stoked by the country’s weak economic data, while the BOJ’s interest rate hike had caught many people off guard. Despite his plan to keep raising interest rates, his acknowledgment of the sharp volatility in the market suggests that the pace of rate hikes will be gradual and remains dependent on the development of the Japanese yen and the stock market. Governor Ueda commented that Japan’s short-term rates remain very low and can be raised to neutral level if the economy continues to improve. Economists in the market expect the BOJ to raise interest rates again in December by another 25 basis points to 0.50%.

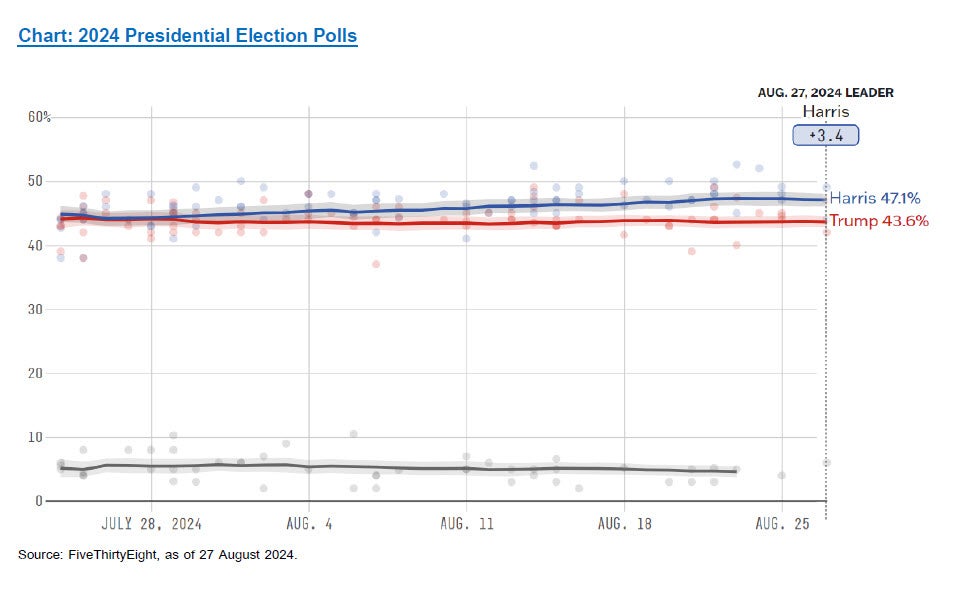

In November, which is only three months away, US citizens will head to the polls to choose the next US president. In late July, the incumbent US President Joe Biden announced his drop out from the election following his disastrous debate performance against Donald Trump. Soon after, Biden announced his backing of his vice president, Kamala Harris, whose nomination had been confirmed last week at the Democratic National Convention that was held in Chicago. According to the latest poll data gathered from FiveThirtyEight.com website, recent trends indicate increasing support for Harris who has a marginal lead over Trump by around 2% to 3%. Since Biden’s withdrawal from the election, Harris has managed to make up the lost ground for the Democrats. Harris and Trump will be facing off with each other in the second presidential debate on Tuesday, 10 September 2024 that will be hosted by ABC News. It will be the first time Harris and Trump debate each other. The debate will be held at the National Constitution Center in Philadelphia. There are no other presidential debates scheduled before the election on 5 November 2024.

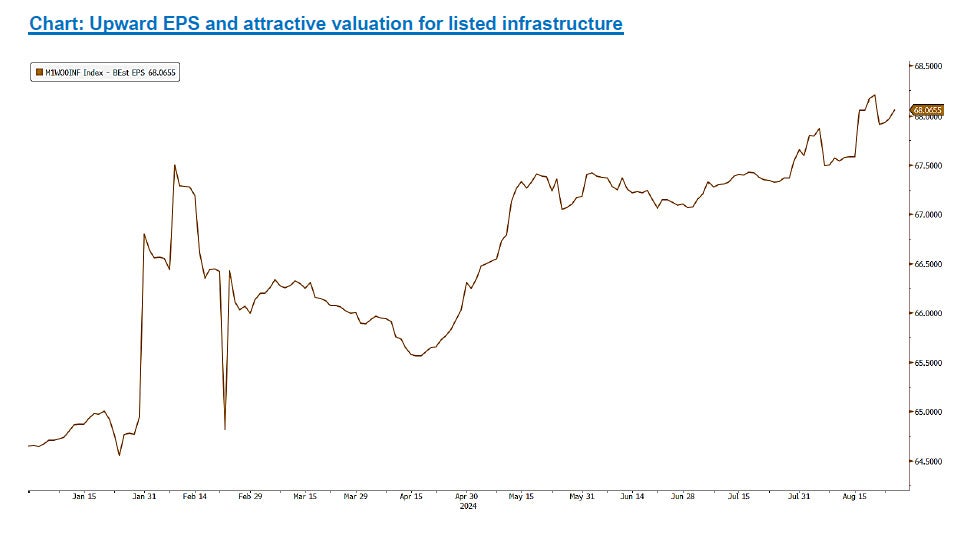

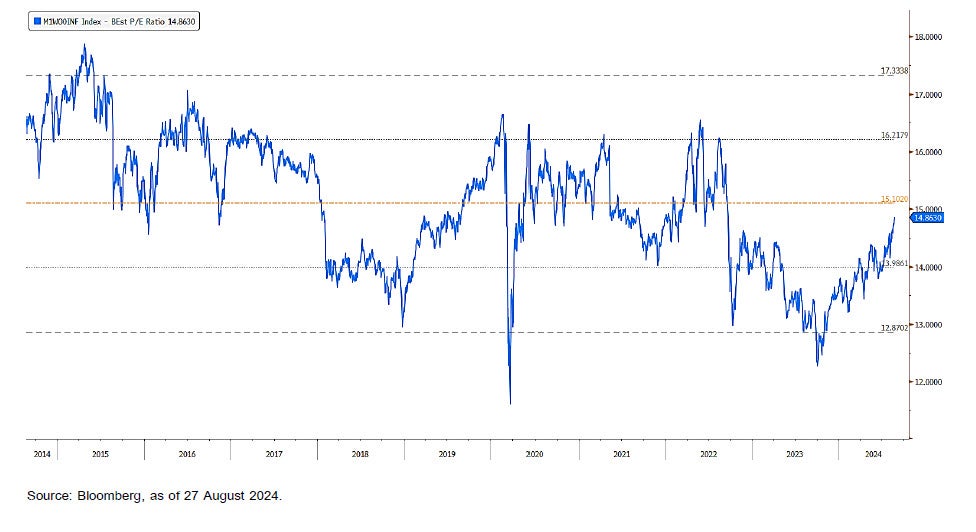

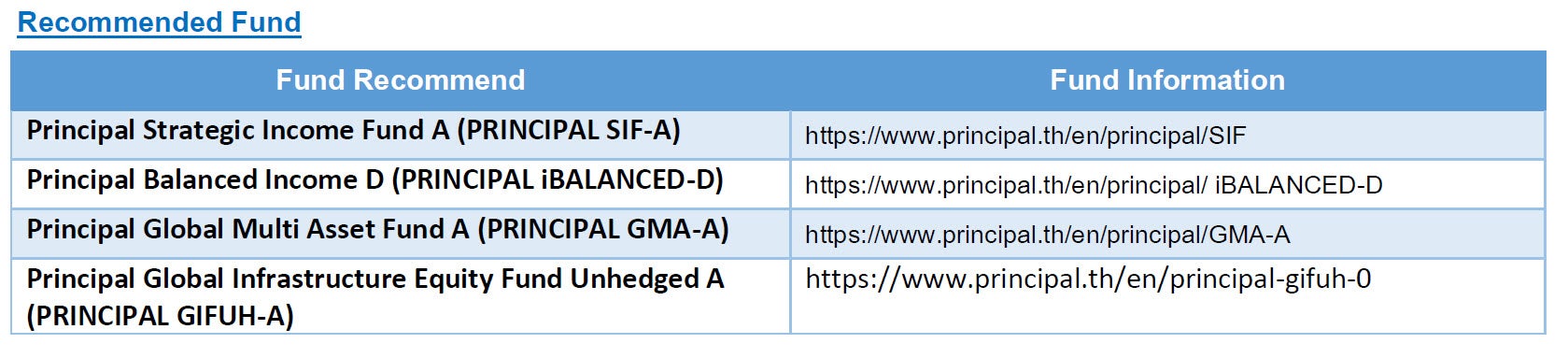

The macro developments and US election uncertainty mentioned above highlight our cautious view for the rest of the year. Our cautious stance towards holding a very large and concentrated equity portfolio still apply, and we believe that a set of right asset allocation funds provide the perfect solution for the very complicated global markets that we’re facing. At Principal, we provide a range of asset allocation funds that offer equity exposure spanning from conservative to a little more aggressive tilt. For the conservative equity weight in the portfolio, our Principal Strategic Income Fund (PRINCIPAL SIF) offers a choice of investment for those who prefer stability over growth in the portfolio, as the fund is broadly targeted to have 60% in income producing assets such as fixed income and 40% in growth assets such as equities. Our Principal Balanced Income Fund (PRINCIPAL iBALANCED) offers a more balanced choice of asset allocation, as the fund is broadly targeted to have 50% in income producing assets such as fixed income and absolute return funds and 50% in growth assets such as equities. Lastly, our Principal Global Multi Asset Fund (PRINCIPAL GMA) offers a choice for those who prefer growth over stability in the portfolio, as the fund is broadly targeted to have just 30% in income producing assets such as fixed income and absolute return funds and 70% in growth producing assets such as equities. These three funds offer the perfect choice to diversify away from an extreme concentrated equity portfolio that many people are currently exposed to. We continue to recommend clients to invest across a broad exposure of asset classes such as fixed income, equities, REITs, commodities, listed private assets, and absolute return strategies, in order to achieve adequate level of diversification for their portfolio. Lastly, we are offering our Principal Global Infrastructure Equity Fund as an “unhedged” version, in order to cater to those who prefer to invest in this type of asset without having to have their returns deducted by the currency hedging cost of approximately 2-3% per year. Principal Global Infrastructure Equity Fund Unhedged (PRINCIPAL GIFUH) offers an investment exposure in listed infrastructure that is considered undervalued, more defensive and stable cash flows in the underlying companies. The timing of the launch during 2 to 11 September is an opportune time for this asset class as we get ready for the Fed to embark on a series of rate cuts starting 18 September.

Disclaimer: Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. / PRINCIPAL GMA has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. / Investors may lose or receive foreign exchange gains or receive a lower return than the initial investment. / The fund and/or the master fund may invest in derivatives for hedging purpose depends on Fund Manager decision, investors may receive gains or losses from the foreign exchange or may receive the money less than the initial investment. / PRINCIPAL GIFUH has highly concentrated investment in Europe, North American, and United Kingdom. So, investors have to diversify investment for their portfolios / PRINCIPAL GIFUH is an unhedged fund, Investors will expose to foreign exchange risk and may receive gains or losses from foreign exchange or may receive money less than initial investment. / Past performance does not guarantee future results.