CIO’s View: March 2023 - The best time to get into global fixed income is now

28 March 2023

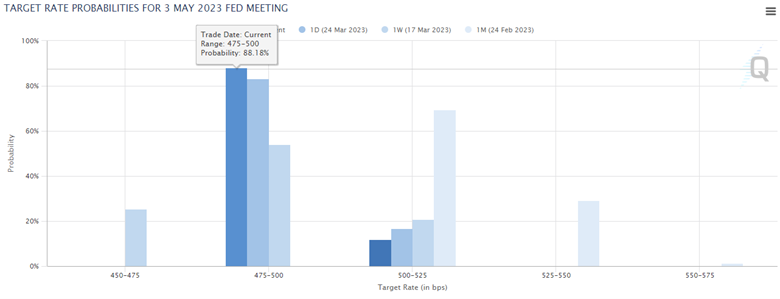

On 22 March 2023, the Federal Reserve has decided to increase the benchmark overnight lending rate by 25 basis points to the range of 4.75%-5.00%, meeting the expectation of market participants. In its accompanying projections, the Fed has signaled that there is just one more rate increase this year, as the median forecast of the Federal funds rate for 2023 was left unchanged at 5.1%, indicating another 25 basis point rate hike. Fed Chair Jerome Powell has also alluded to the outlook that the regional bank issue in recent weeks is likely to result in tighten credit conditions. We believe that should likely the case as small banks in the US tend to have around 50% lending market share in Commercial & Industrial loans and Consumer loans, while having even higher share of around 60% in Residential Real Estate loans, and even higher around 80% in Commercial Real Estate loan. Therefore, logic follows that tougher lending activities by these banks should result in slower US economy in the quarters ahead. Estimate by some analysts have put the effect of the tighter lending to be equal to around one to two 25 basis point hikes. This looks reasonable at the moment, and so market participants have reduced their previous expectation of peak terminal Fed funds rate at 5.375% from one month ago down to 4.875%, which means no more rate hike is expected this year, as shown in the implied probabilities of rate increase compiled by CME FedWatch Tool for the FOMC meeting on 3 May 2023. Ultimately, much will depend on incoming growth and inflation data during the time before the next meeting. With the narrative from the news and the projections published by FOMC, it is still high probably that they might opt for another increase. However, that might prove to be the last rate hike by the Fed in this cycle.

Chart: Fed’s target rate probabilities for 3 May 2023 FOMC Meeting

Source: CME FedWatch Tool, CME Group, as of 25 March 2023.

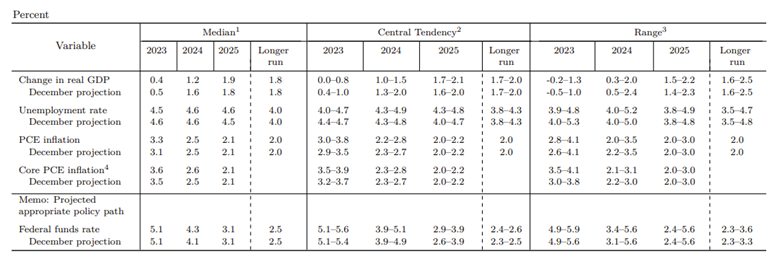

The accompanying economic projections by the FOMC at the March meeting showed some changes of note. The FOMC reduced GDP median forecast to 0.4% from 0.5% in 2023, and to 1.2% from 1.6% in 2024. Unemployment rate median forecast was reduced to 4.5% from 4.6% in 2023, while 4.6% in 2024 was maintained. PCE inflation median forecast was increased to 3.3% from 3.1% in 2023, while 2.5% in 2024 was maintained. Core PCE inflation median forecast was increased to 3.6% from 3.5% in 2023, and to 2.6% from 2.5% in 2024. For me, key takeaway from reading these numbers is that the Fed expects weaker economic growth from recent developments, while the stubbornly strong labor market will continue to put upward pressure in the inflation prints up in 2023-2024, until finally coming down towards their 2% target only in 2025. This ultimately explains why they kept their median forecast on the Fed funds rate at 5.1% in 2023, and only in 2024 do they start to project rate cuts to 4.3%, which implies a total rate cuts of 80 basis points expected by the Fed.

Chart: Economic Projections of FOMC Members for March 2023

Source: Summary of Economic Projections, Board of Governors of the Federal Reserve System, as of 22 March 2023.

Aside from the FOMC meeting, regional banking issues have continued to dominate the sentiment and movements of the financial markets during the past month, in the wake of Silicon Valley Bank and Signature Bank collapse. However, the regulators have moved with great speed to provide extraordinary support to provide guarantees to the depositors to stem the bank run, and the short-term one-year loan support to the banks that allows the banks to pledge US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. This so-called Bank Term Funding Program (BTFP) will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress. To me, the key takeaway from the developments on the issue of US regional banks thus far, is that the problem won’t become systemic. However, as I have talked about earlier, the reduced lending activities by these banks will have negative implications for the US economy, making the economic growth slower than expected or even to the point that any oncoming recession will become bigger in magnitude, all else being equal.

In the Eurozone, the ECB hiked rates by 50 basis points on 16 March 2023, as widely expected by market participants, bringing the deposit rate to 3.00%. European economies continued to retain their recovery momentum, with data points coming in stronger than expected during the past couple of months, while inflation prints have been coming in stronger than expected as well. In light of this, the ECB may need to continue with the rate hikes by a few more times before we eventually see the peak in the policy rate at 3.50% or maybe even 3.75%.

Meanwhile, last month’s focus has been on the demise of Credit Suisse that have been under significant pressure from negative developments for some time, and eventually the loss of confidence by the markets. The US banking stress had acted as a catalyst to push the CDS spread to approach 1,000 basis points, forcing the Swiss National Bank to announce liquidity support, and eventually a SNB-led takeover of CS by UBS bank. The focus of the market has since moved on to the fallout on the AT1 debt market. Market participants were surprised that the Swiss authority would decide to forego the usual seniority of debt over equity in the capital structure in order to make payments to equity holders. The wipeout of the AT1 debt of CS by the regulator has raised concern on the entire AT1 market, since it implied that debt was being made junior to equity. This then implied that debt investors should demand a much higher cost of capital for this type of debt, triggering selloff on AT1 securities, while acting as an overhang for the banking sector overall. However, we take note that this is a specific problem to the banking sector in Switzerland. The other European regulators had quickly moved to announce that the seniority of debt over equity would be respected, which had subsequently calmed down the concerns by the market. Taking a look at the European banking sector, we note that the capital of the banks is at a very strong level overall, while the net interest margins have been improving along with the interest rate hikes by the central banks. This means that the CS issue should remain an idiosyncratic one, and that the risk of this becoming systemic is not very high. Ultimately, this is a problem of confidence that was caused by a specific situation of one bank on an otherwise healthy banking sector. We expect this subside in due time, and the improving outlook of the European economy to ultimately lead the European markets higher.

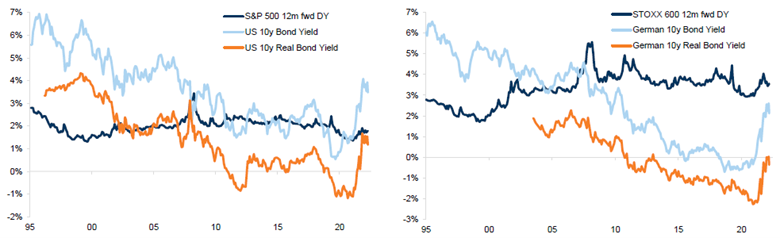

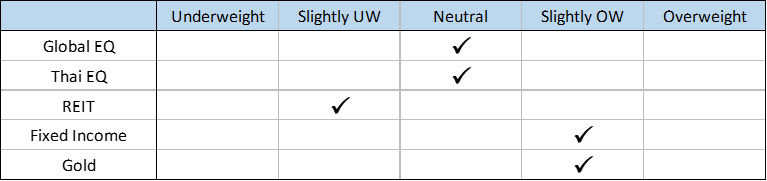

With the outlook for the US economy that is weaker due to high probability that the banks will be tightening lending standards in the coming quarters, this has served to highlight the headwinds for US equities in the near-term, and for global equities as well as US equities takes up around 60% weight of global equity markets. Our near-term call is to be conservative in terms of risk-taking, by downgrading overall equity weights to neutral, while taking fixed income weights to slightly overweight via foreign fixed income. Global REITs is also taken down to slightly underweight due to worsening outlook for near-term US growth, and to use the weight to fund the slight overweight in global fixed income. A slight overweight to gold is maintained due to dollar turning to weakening cycle benefiting gold. Within equities, we recommend underweighting US equities, and overweighting Europe, Japan, and China. Expensive valuation continues to point to weak outlook for US equities, both versus other regions and versus bonds (see valuation study done by Goldman Sachs Global Investment Research).

Chart: US 10y bond yield is well above dividend yield (left);

Europe offers higher dividend yield vs bonds (right)

Source: Datastream, FactSet, Goldman Sachs Global Investment Research, as of 17 March 2023.

Chart: Near-term asset class outlook over the next 1-3 months

Source: Principal Thailand, as of 26 March 2023.

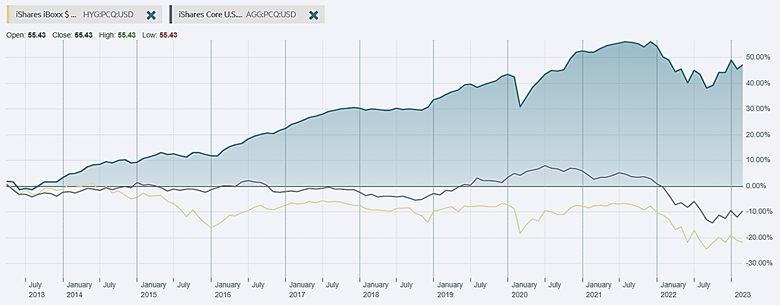

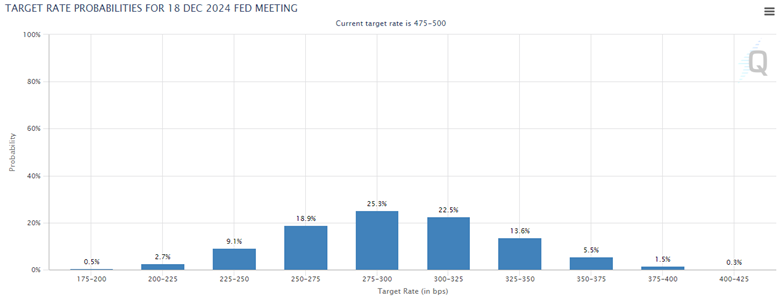

US equity market looks significantly unattractive when compared against IG credit (see comparison study done by Goldman Sachs Global Investment Research). There is near zero company now offering a yield spread relative to IG credit, indicating significantly less payout for equity holders versus bonds. So why go bullish US equities now when you can be more suitably compensated for your investments by being in a better choice such as a global income bond fund. A historical look at the PIMCO GIS Income Fund in the chart below reveals that long-term investors are handsomely rewarded by buying and holding this fund over the long term versus choosing to invest purely in either IG bonds (represented as “AGG:PCQ:USD” in the chart below) or HY bonds (represented as “HYG:PCQ:USD” in the chart below). The drawdown as year of -11% for global bonds, -17% for global IG bonds, and -11% for global HY bonds also sets a very beautiful backdrop for a good entry point into the asset class. Remember that fixed income is most sensitive to rate hikes, and that the majority of rate hikes already happened in 2022. There will not be another opportunity like this in the near future, as the Fed is getting closer to pausing, while next year, we will most likely see at least 80 basis points of rate cuts by the FOMC’s own set of forecasts, even more shockingly by 200 basis points according to CME FedWatch Tool based on the futures contract maturing on 18 December 2024 (see CME FedWatch Tool chart below). We recommend investors to check out our feeder fund – Principal Global Fixed Income Fund (PRINCIPAL GFIXED).

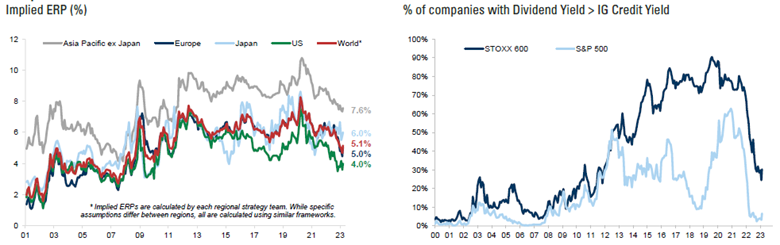

Chart: Equity risk premium has fallen to 15-year low in the US (left);

few companies now offer yield spread relative to IG credit

Source: Datastream, FactSet, STOXX, Goldman Sachs Global Investment Research, as of 17 March 2023.

Chart: Historical chart of PIMCO GIS Income fund versus IG and HY bond ETF

Source: Funds, FT.com, as of 26 March 2023.

Chart: Fed’s target rate probabilities for 18 December 2024 FOMC Meeting

Source: CME FedWatch Tool, CME Group, as of 25 March 2023.

Fund Recommend

Read CIO’s View: March 2023 - The best time to get into global fixed income is now