CIO’s View: June 2023 - Quality investing for turbulent markets ahead

30 June 2023

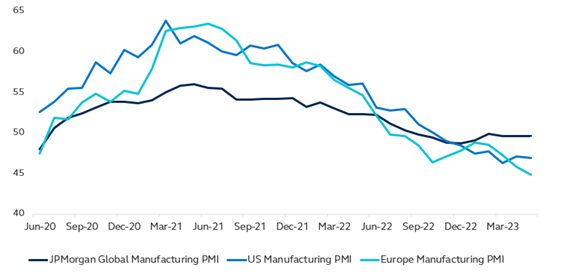

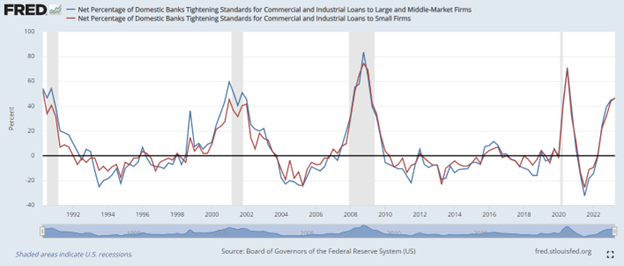

Although the global economy has been resilient, benefitting from the strong pent-up demand and high savings rate, along with the stimulus programs put in place during the pandemic, the rapid and massive increase in central bank’s policy rates globally is starting to show negative effects to the global economy. The non-farm payroll number released at the beginning of the month still points to strong labor demand overall, with the 339k increase being significantly more than the 180k expected increase. The weak component was the manufacturing payrolls, which declined significantly by 2k rather than the 8k increase expected. The strong overall labor demand is also now being accompanied by rising layoffs. The initial jobless claims have been rising more than expected over the past three weeks, pushing up the 4-week average jobless claims continuously higher to 256k recently. The DM manufacturing PMI also took a significant further step down to 46.5, its lowest non-recession level in its history dating back to 1998. The detail of the survey shows a significant drawdown of inventory, which coupled with the sharp decline in the PMI orders points to a potential for further weakening of manufacturing activities. Moreover, financial conditions have tightened significantly, as lending conditions have tightened further in the second quarter for both large and small firms across the US.

Chart: Global, US & Eurozone’s Purchasing Manager Indices

Source: Bloomberg, as of 28 June 2023.

Chart: Fed Senior Loan Officer Survey – net percentage of banks tightening loan standards

Source: Board of Governors of the Federal Reserve System (US), FRED, Federal Reserve Bank of St. Louis, as of 8 May 2023.

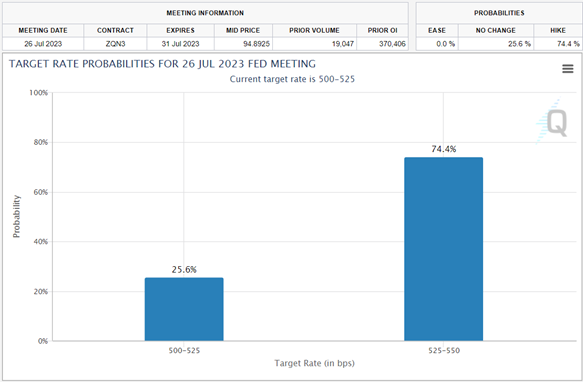

On the positive side, US headline inflation numbers have continued to moderate to 4.0% in May, while core inflation numbers have also moderated to 5.3%, but with a slower pace than the headline inflation. The stubbornness of core inflation numbers have been widely cited by the economists and also the Fed. Nevertheless, as the overall inflation numbers moderating significantly and negative momentum starting to show in the labor market, further aggressive interest rate hikes by the Fed is becoming less warranted. The Fed has decided to pause its string of rate hikes in June, as the effect on the economy and inflation have started to take effect, although the Fed now wants to pause to better assess the effect that the say has a long and variable lags. Incoming data will be critical in the future path of rate hikes. But to the Fed’s point, it is worth noting that they have already hiked the Fed funds rate by 500 basis points since March 2022. The futures market is now pricing in just one more 25bp hike to the range of 5.25%-5.50% by July, judging by the market probability shown in the CME FedWatch Tool. Currently, market has priced out rate cut for the rest of this year, with the first rate cut being expected to happen in 1Q24.

Chart: Market’s Expectation of policy rate hike by the Fed in Jul

Source: CME FedWatch Tool, as of 28 June 2023.

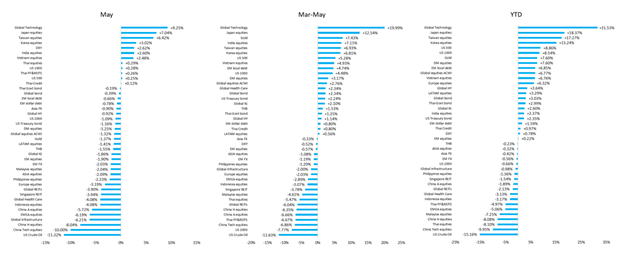

Looking at global markets performance in May, Global equities (-1.3%) underperformed global bonds (-0.4%) during May. Thai equities (+0.3%) performed better than Asian equities (-2.1%) and EM equities (-1.9%), while Thai bonds (-0.2%) performed marginally better than global bonds (-0.4%). Outperformers were global tech (+9.3%), Japan equities (+7%), Taiwan equities (+6.4%), and Korea equities (+3%). Chinese A-shares -5.7%, H-shares -8%, and Chinese tech -10%. Thai baht was down by -1.6% in May, while US dollar rallied by +2.6%. Within equities, global tech performed well in the 3-month period (+20%) due to US regional banking sector concern resulting in funds switching to large and profitable tech companies, along with supportive economic data during the period and speculation of Fed pause. The YTD 30%-plus return now puts global tech in dangerous territory, as some of the popular names such as NVIDIA and AMZN has PE of 182x and 134x, indicating significant bubble in the sector.

Chart: Global Markets Performance as of end-May

Source: Bloomberg, as of 31 May 2023.

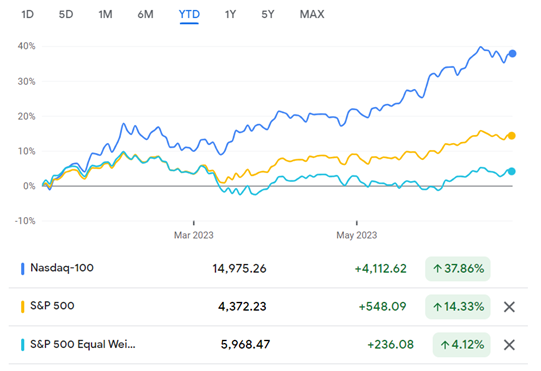

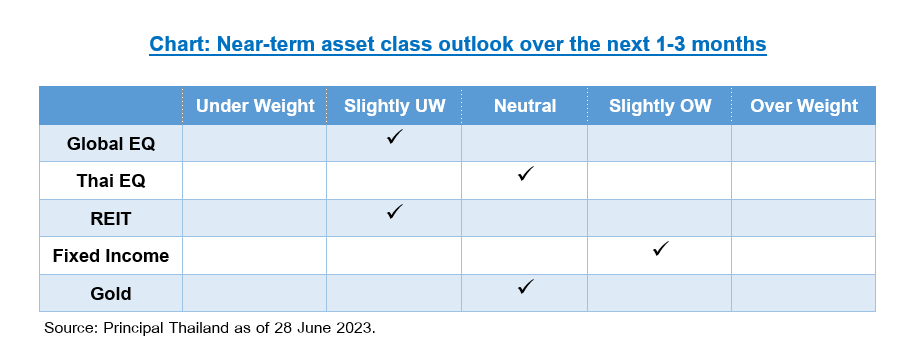

The stark difference in YTD performances between NASDAQ 100, S&P 500 and S&P 500 Equal Weight Index points to the susceptibility that the broad S&P 500 to a potential large downturn going forward when the few mega cap technology names fail to deliver the high level of earnings that investors expect. In the near term, which is over the horizon of about 1-3 months in our lingo, we are still advising readers to be cautious and skeptical about this unhealthy rally of the equity market. However, rather than avoiding equity exposure altogether, we would prefer to position our equity exposure towards quality companies rather than tech companies via Principal Global Equity ESG Fund (PRINCIPAL GESG) and Principal Global Quality Equity Fund (PRINCIPAL GQE), which is due to be launched during July. We still maintain our call to be invested in Principal Global Fixed Income Fund (PRINCIPAL GFIXED), as the low volatility nature of this fund offers stability to the portfolio, while the higher yield level versus history offers income cushion against some losses that may occur due to the volatile nature of the equity market.

Chart: YTD Performances of NASDAQ, S&P 500 and S&P 500 Equal Weight Index

Source: Google Finance, as of 28 June 2023

The stark difference in YTD performances between NASDAQ 100, S&P 500 and S&P 500 Equal Weight Index points to the susceptibility that the broad S&P 500 to a potential large downturn going forward when the few mega cap technology names fail to deliver the high level of earnings that investors expect. In the near term, which is over the horizon of about 1-3 months in our lingo, we are still advising readers to be cautious and skeptical about this unhealthy rally of the equity market. However, rather than avoiding equity exposure altogether, we would prefer to position our equity exposure towards quality companies rather than tech companies via Principal Global Equity ESG Fund (PRINCIPAL GESG) and Principal Global Quality Equity Fund (PRINCIPAL GQE), which is due to be launched during July. We still maintain our call to be invested in Principal Global Fixed Income Fund (PRINCIPAL GFIXED), as the low volatility nature of this fund offers stability to the portfolio, while the higher yield level versus history offers income cushion against some losses that may occur due to the volatile nature of the equity market.

Fund Recommend

- Principal Global Equity ESG Fund A (PRINCIPAL GESG-A)

- Principal Global Fixed Income Fund (PRINCIPAL GFIXED)

- Principal Global Quality Equity Fund (PRINCIPAL GQE) Launched IPO during 12 -21 July 2023

Read CIO’s View: June 2023 - Quality investing for turbulent markets ahead

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. PRINCIPAL GESG Master fund has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios. PRINCIPAL GESG is not subject to sustainability disclosure, management and reporting requirements of mutual fund as SRI Fund of Thai SEC/ PRINCIPAL GQE Master fund has highly concentrated investment in United States./ Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ Investors should understand characteristic of mutual fund, return conditions and risk before investing Copyright @ 2023 Morningstar Thailand All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.