CIO's view June 2022 Central Banks Stepping on the Brakes

By Supakorn Tulyathan, CFA - Chief Investment Officer

June 20, 2022

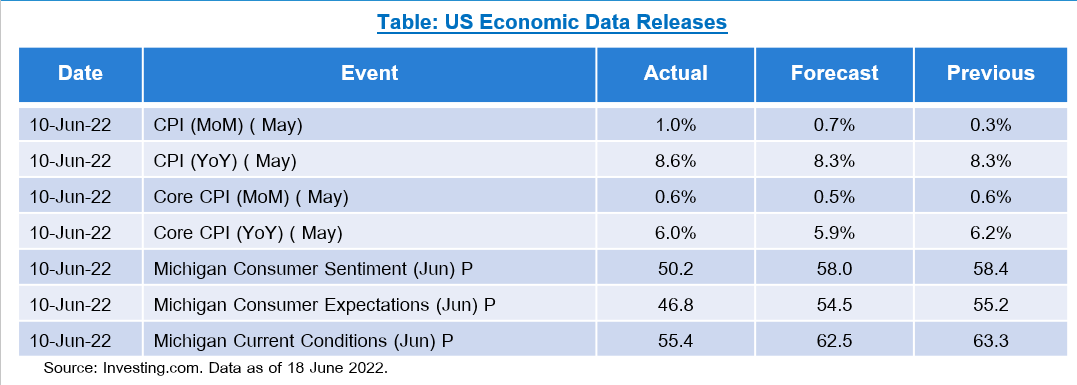

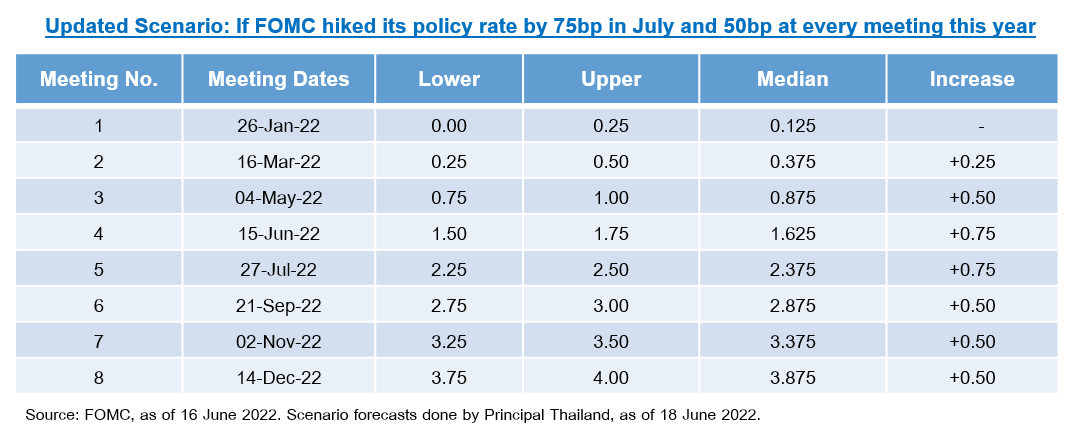

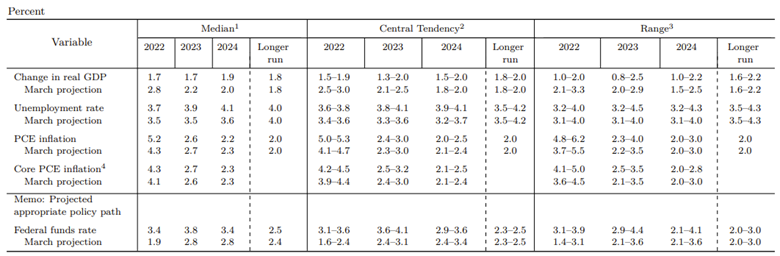

This month’s outlook will carry on the investment theme from CIO’s View (please follow the link here to read - https://www.principal.th/th/CIOs-View-May-2022) that was written in May, reiterating the importance of staying cautious amid a highly volatile macroeconomic environment. As it turned out, we were right on the spot last month when we predicted the possibility of the Fed being more aggressive that what the market had expected. We alluded to the possibility that the Fed could raise its policy rate by 50bp at every FOMC meeting during the rest of this year, the fed funds rate will end the year 2022 at 3.50% (fed funds upper target), resulting in what the market had expected for the fed funds rate at 2.75% at the end of 2022 being way too low. As a result of our higher expectation, we estimated that the 10-year US Treasury bond yield could start to trade up to around 3.5-3.6% when the Fed got more hawkish that what the market had expected (see our chart on 3.2-3.6% technical trading range the estimated back in the previous CIO’s View in May, which is also provided below). Indeed, the result of the FOMC meeting on June 15 showed that the Fed was more aggressive than market had expected, when they decided to hike its policy rate by 75bp to the range of 1.50-1.75% as a result of higher inflation reading the previous week. US reported a CPI inflation number for May at 8.6% y/y, which was higher than market expectation of 8.3% and also higher than the previous month 8.3%. When looking at the month-on-month number at 1.0% for May, this was a much bigger increase than April’s 0.3% m/m. The same day that inflation numbers were released, we also had an announcement of preliminary Michigan Consumer Sentiment for June, showing a sharp drop from 55.2 in May to 46.8 in June that indicated a negative effect that high inflationary environment is starting to have to the consumers. This should mean that our previous expectation of end-2022 fed funds rate at 3.5% might even be too low. Depending on whether the inflation readings will start to meaningfully come down or not, for example, if the Fed hiked another 75bp in July and then did 50bp for the rest of the meetings this year, we would see the fed funds rate at 4.0%, which will definitely be more problematic for risk assets around the world in the second half, even though the main market such as the US has already gone into bear market territory of more than 20% decline from peak.

Chart from CIO’s View in May: Technical Trading Range for 10yr US Treasury 3.2% to 3.6%

Source: Bloomberg Finance, L.P., as of 7 May 2022. Analysis done by Principal Thailand, as of 7 May 2022.

Chart: 10yr US Treasury was recently traded at 3.2%

Source: TradingView. Data as of 18 June 2022.

Updated FOMC Dot Plot: Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, June 2022

Source: Board of Governors of the Federal Reserve System. Retrieved from https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220615.htm on 18 June 2022.

Meanwhile, a storm is brewing in the European continent. Bond yields for selected European countries have been rising. Going back to around 2010-2013 period, Portugal, Italy, Ireland, Greece, and Spain (aka. PIIGS) had seen the yields on their government bonds rising to dangerously high levels, reflected the weak condition of their public finances due to their high debt-fueled spendings in the past. Higher bond yield spreads of these highly indebted countries reflect investors’ concern that the ECB will be tightening monetary policy more aggressively than previously expected, which may be detrimental to these countries that have high debt-to-GDP ratios. At the same time, the ECB did not previously provide any details about possible measures to support these highly indebted countries. As a result of market pressure that saw Italy’s 10-year bond yield reaching 4.2%, the ECB convened an emergency meeting on June 15, just hours before the FOMC meeting result was due to be released. The ECB announced that they will be creating a new tool called “anti-fragmentation instrument”, which will be a new bond-buying program aimed at shielding weaker Eurozone economies from higher borrowing costs, as the ECB looks to raise its policy rate by 25bp in July. No further details were announced. However, the ECB signaled that in the immediate future, they plan to reinvest money received from maturing debt under an existing bond-purchase program (PEPP) toward weaker Eurozone countries, which could equate to around EUR200bn of additional bond purchase this year.

Chart: Bond Yield Spreads of Portugal, Italy, Ireland, Greece, and Spain (aka. PIIGS)

Source: TradingView. Data as of 18 June 2022

Over in Japan, the Bank of Japan maintained its ultra-loose monetary policy, in stark contrast to the other developed market central banks. BOJ Governor Haruhiko Kuroda admitted that the recent sharp decline in the yen adds to negative outlook on the economy due to the uncertainty that impacts investment decision. However, the BOJ ruled out expanding the upper band of the yield-curve control on the 10-year bond yield at 0.25%, preferring to maintain monetary support for the economy, even though Japan’s CPI has climbed to 2.5% in April.

Chart: Japan’s CPI Inflation Rate

Source: TradingView. Data as of 18 June 2022.

Chart: JPY Depreciating to higher than 134 per 1 USD, weakest since Asian Financial Crisis

Source: TradingView. Data as of 18 June 2022.

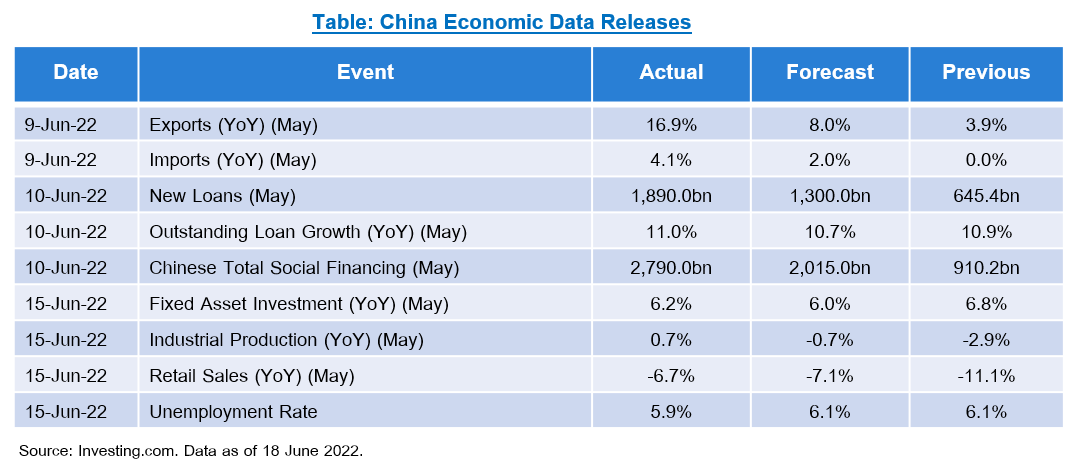

China’s economic activity readings for May beat expectations, pointing to evidence of recovery resulting from relaxation of the Zero-Covid policy that we have been waiting for. Exports (+16.9% in May from 3.9% previous), new loans (CNY1,890bn in May from CNY645bn previous), and industrial production (+0.7% in May from -2.9% previous) had rebounded remarkably. The government has recently announced a series of growth-supporting policies in recent weeks, focusing on corporate rescue measures and boosting infrastructure investment. The next policy signal will come from the 13th NPC Standing Committee meeting that will convene for its 35th session from June 21 to 24.

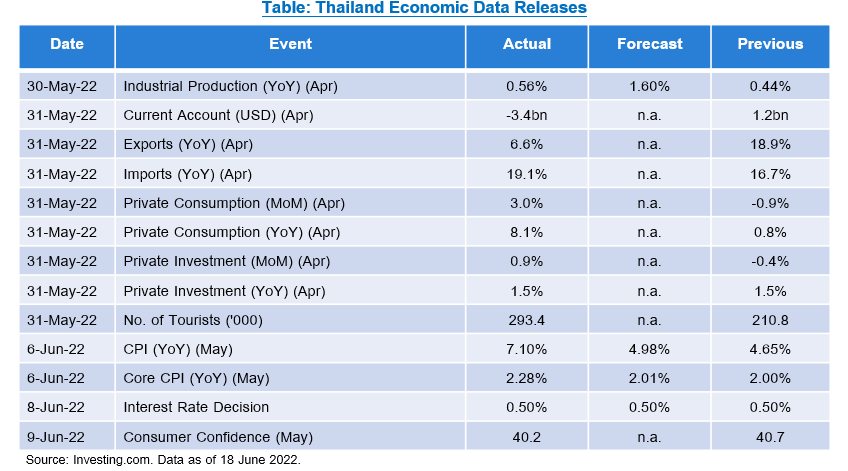

Thailand’s inflation rose to 7.1% y/y in May, highest level in nearly 14 years, and higher than median estimate of 4.98%. Inflation was driven mainly by energy and food items. Core inflation rose to 2.28% y/y. The private consumption index (PCI) rose 8.1% y/y in April. Key drivers were the services index (+16.4%), durables (+3%), and non-durables (2.5%). This improvement reflected declining concerns over the Omicron outbreak which led to improvement in various economic activities. The private investment index (PII) rose 1.5% y/y in April. Key supporting factors were permitted construction areas (+8%), construction material index (+7.6%), and real domestic machinery sales (+4%), as construction activity picked up from the economic reopening. Thailand recorded a current account deficit of $3.4 billion in April after a surplus of $1.2 billion in the previous month. Thailand’s consumer confidence fell for a fifth straight month in May to reach the lowest level since August on concerns about rising oil prices and the cost of living. The index fell to 40.2 in May from 40.7 in April. BOT voted 4-3 to hold its key interest rate at 0.5%, as expected, maintaining support for a slow recovery in the face of global uncertainty. The governor said that delaying an interest rate hike too long would not be good as inflation continues to rise, but any hikes in interest rates will be gradual. We expect the BOT to start hiking its policy rate in August this year. The government announced on Friday, June 17 that it would abandon its pre-registration process for foreign visitors and no longer require face masks to be worn in public due to lower Covid-19 spread. The Thailand Pass system, where foreign tourists must seek prior approval from Thai authorities, will be halted from July 1. The Tourism Authority of Thailand (TAT) will propose a visa fee exemption for international arrivals and an extension for visitors from nations not requiring a visa to enter the country from 30 to 45 days during the second half of this year. However, on the negative side, the Finance Ministry plans to propose to the cabinet the implementation of a financial transaction tax on individual stock investors in the near future. Once the tax is enforced, concerned parties will still have a grace period of 90 days to prepare to comply with the tax collection. The financial transaction tax is 0.1%. In addition to the transaction tax, investors are subject to a related local tax, which would bring the total tax to 0.11% per share sold. Another negative to the inflation backdrop is the increase of the minimum Thai wage for workers in 16 careers (account for 20% of workforce), focusing on workers in construction, service and industrial industries. The wage is increased up to 650 baht per day from the former rate of about 313 – 336 baht per day. The policy was launched on June 10 and would be effective within 90 days.

We maintain our view of remaining cautious for the time-being. Economic activities in developed markets have started to show negative impact from monetary policies being tightened to fight inflation. Inflation numbers have been surprising to the upside, leading to central banks being more hawkish. This in turn has renewed market selloff for equities globally. We still favor asset allocation type of funds that have a mixture of other asset classes besides equities that diversify risk to the portfolio, such as Principal Global Multi Asset Fund (PRINCIPAL GMA), which usually has global equity exposure of around 70%, and Principal Balanced Income (PRINCIPAL iBALANCED), which usually has Thai plus global equity exposure of around 30%. For pure equity funds, we like those with quality plus growth character, such as Principal Global Brands Fund (PRINCIPAL GBRAND), which invests in high quality companies with dominant market positions; and Principal Global Equity ESG Fund (PRINCIPAL GESG), which invests in high quality companies that meet sustainability criteria of the investment manager. Additionally, due to improving outlook for China, we have a positive outlook for Chinese equity funds, namely Principal China Equity Fund (PRINCIPAL CHEQ), which invests in companies in Chinese companies both onshore and offshore. We also like Principal China Technology Fund (PRINCIPAL CHTECH), which invests in Chinese technology companies. Finally, as China improves, so should the Asia-Pacific region, so we recommend Principal Asia Pacific Dynamic Income Equity Fund (PRINCIPAL APDI), which invests in Asia-Pacific ex-Japan companies.

Fund Recommendation

Principal Global Multi-Asset Fund (PRINCIPAL GMA)

Principal Balanced Income (PRINCIPAL iBALANCED)

Principal Global Brands Fund (PRINCIPAL GBRAND)

Principal Global Equity ESG Fund (PRINCIPAL GESG)

Principal China Equity Fund (PRINCIPAL CHEQ)

Principal China Technology Fund (PRINCIPAL CHTECH)

Principal Asia Pacific Dynamic Income Equity Fund (PRINCIPAL APDI)

Read CIO's view as of June: Central Banks Stepping on the Brakes

Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision. /PRINCIPAL GMA master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios./ PRINCIPAL GBRAND master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios/ PRINCIPAL GBRAND master fund has concentrated investment in the consumer staples sector, which is exposed to risk from changes of the product price, consumer demand or government regulations. The fund concentrates in the information technology sector, which has a risk from changes in consumer behavior and obsolete products. Therefore, if there are negative factors affecting the said investment, investors may lose a lot of money and may have higher risks and price fluctuations than general mutual funds that diversify its investment in many industries. /PRINCIPAL GESG master fund has highly concentrated investment in America. So, investors have to diversify investment for their portfolios. /PRINCIPAL CHEQ master fund has highly concentrated investment in China. So, investors have to diversify investment for their portfolios. /PRINCIPAL CHTECH master fund has highly concentrated investment in China. So, investors have to diversify investment for their portfolios. /PRINCIPAL APDI master fund has highly concentrated investment in Hong Kong. So, investors have to diversify investment for their portfolios. /Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment. /Past performance of the fund is not a guarantee for future performance