CIO View: October 2023 - Overweight Investment Grade Credit

By Supakorn Tulyathan, CFA - Chief Investment Officer

31 October 2023

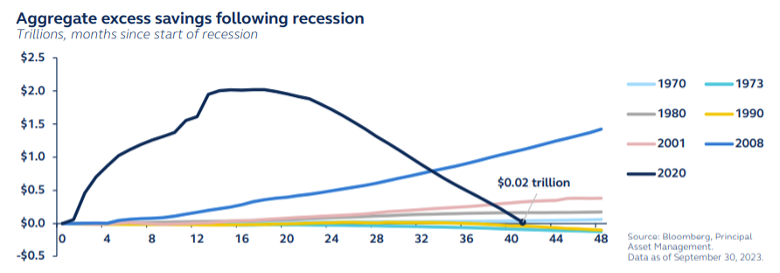

US GDP growth the third quarter came in at a solid 4.9% annualized rate, beating consensus expectation for a 4.3% growth rate. Within the detail, consumer spending rose by 4.0% rate; while business investment was roughly flat; and residential investment rose at a 3.9% rate. Federal government spending rose strongly at 6.1% rate; and the state & local government spending also rose strongly at 3.7% rate. The US federal budget deficit rose sharply from FY2022 to FY2023. The deficit totaled $1.695 trillion or 6.3% of GDP in FY2023, up from $1.375 trillion or 5.4% of GDP in FY2022. The sharp improvement in Q3 GDP growth associated with the report of the large increase in the budget deficit had us wondering if this was the main catalyst, alongside the solid growth of consumer spending. However, we are of the view that consumer spending in the US will start to slow materially due to the depletion of the excess household savings of the US economy, which had fuelled consumer spending and helped prevent a build-up in household indebtedness, has been significantly run down. Assuming the pace of drawdown in excess household savings persists, it will be exhausted within the next few months. While fiscal support and excess savings have shielded consumers from tighter monetary policy, by early 2024, many households will be exposed to the full burden of higher rates.

Chart: Excess household savings had been rundown to $0.02 trillion from $2 trillion in 2021

Source: Bloomberg, Principal Asset Management. Data as of 30 September 2023.

In Europe, the October PMIs showed subdued economic activities. The Euro area composite PMI decreased to 46.5 points, from previous 47.2 points and below consensus expectation of 47.4 points, driven by a decline in the services sector. The report cited broad-based slowdown across the Euro area, with France’s contraction moderated due to softer service-sector decline. On the other hand, both the service and manufacturing sector accelerated the decline in Germany. France and Germany have now seen up to five months of declining output. The Euro area’s lower output volumes were attributed to weak demand, client hesitancy and tighther financial conditions. While in the UK, the composite PMI improved marginally to 48.6 points, driven by a pickup in manufacturing. On 26 October 2023, the ECB’s Governing Council kept policy rates unchanged at its October meeting, as incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook. The interest rates on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility wil remain unchanged at 4.50%, 4.75% and 4.00% respectively. President Lagarde indicated that neither an earlier end to the Pandemic Emergency Purchase Programme (PEPP) reinvestments nor changes to the reserve remuneration were discussed at the meeting. We expect the Governing Council to remain firmly on hold until the first cut in the second half of next year.

Monetary policies are diverging across emerging markets, with some Asian central banks resuming rate hikes given currency and inflation pressure. Indonesia’s central bank surprised the market with a 25 basis point hike to the 7-day reverse repo rate to 6.0% after several months of remaining on hold, citing the move as pre-emptive and forward-looking measure to mitigate the impact of imported inflation. Indonesia’s latest CPI inflation was at 2.28% in September, which had fallen back in to the central bank’s target inflation range of 2% to 4% in May. The bank also raised its overnight deposit facility rate and lending facility rate by 25 basis points each to 5.25% and to 6.75% respectively. The Philippines’s central bank also surprised the market with a 25 basis point rate hike in key policy rates, citing the move as urgent in order to rein in inflation. The benchmark overnight reverse repurchase rate was increased to 6.50%, effective on 27 October 2023. The country’s CPI inflation in September increased 6.1% from a year earlier, from 5.3% rate in August, and compared to the central bank’s target range of 2% to 4%.

China’s National People’s Congress (NPC) approved an RMB1 trillion additional central government bond (CGB) issuance quota, equivalent to 0.8% of GDP, to support infrastructure projects. This was interpreted by the market as more-than-expected easing, since this is only the fourth new special central government bond in 25 years. Given the demand for funding, this has kept the market’s expectation of another 25 basis point cut in reserve requirement ratio and another 10 basis point cut in key policy rates by the end of this year. China reported GDP for Q3 on 18 October 2023, which was a deceleration in year-over-year rate to 4.9% from 6.3% in Q2, but this was better than market’s expectation of just 4.4%. This was due to the quarter-on-quarter growth rate of 1.3%, an improvement from the 0.5% growth recorded back in Q2, and better than the market’s expectation of just 1.0%. Despite the improvement seen, continued policy easing is still needed to support growth this year and next, given the fading reopening impulse and lingering risks in the economy, including uncertainty around the sustainability of the strength in household consumption, local government debt problems, and the ongoing property downturn. The latest approval of RMB1 trillion in central government bond issuance by the NPC is a case in point in support of this view that more easing should be coming.

Although oil prices have risen from pre-conflict levels, prices could rise further if core OPEC countries were unable to deploy their spare capacity of around 4 million barrels per day. Current view in the market is that the US would only be able to offset only a portion of the potential drop in supply, which underscores the key role of OPEC in balancing the oil market. While gold prices also surged in response to the conflict in the middle east, we don’t expect strong upside for gold this time around due to the higher US real rate environment that is positive to the US dollar and negative to gold. This would mean that crude oil and other soft commodity complex could be a better hedge against further escalation in the geopolitical risk.

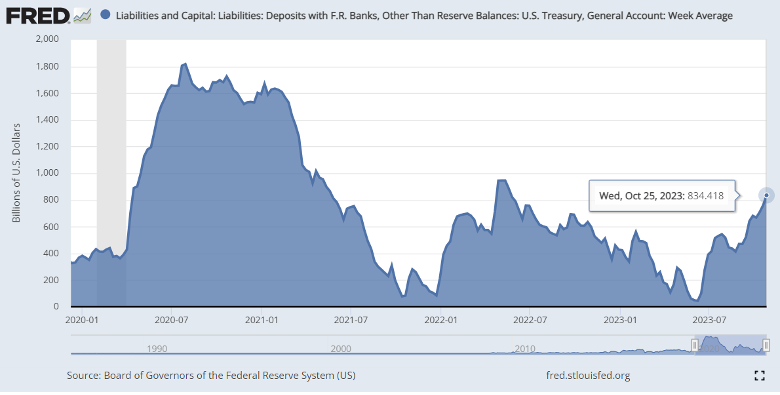

Immediately as we release this month’s CIO View, the FOMC decision on its monetary policy meeting will be due as they conclude the meeting on 1 November 2023, which investors in Thailand will know the result by Thursday morning. We expect the FOMC will leave the target rate for the Fed funds rate unchanged at 5.25% to 5.50% target range. With no new FOMC economic projections due to be released, attention will turn to the statement and the press conference by the Chairman. We expect the statement will be largely unchanged, leaving intact the tightening bias with the dependency on the data, and the message that rates will remain restrictive for some time. Another key piece of data that we are closely monitoring is the announcement on the US Treasury bond supply for Q4. The Treasury had previously estimated on 31 July 2023 that it expected to borrow $852 billion, assuming an end-of-December cash balance of $750 billion. However, we noticed that the current level of the US Treasury General Account is at $834 billion, which is a significant improvement compared to the low of $45 billion on 7 June 2023. Assuming that the release of the October to December 2023 amount of Treasury bond supply corroborates our view of a lower amount than the $852 billion that was announced last time, this should be positive on global bond yields. The caveat here is that the US Treasury’s higher government borrowing estimates could lead to an increase in Treasury issuance.

Chart: US Treasury General Account (millions of US dollars)

Source: US Board of Governors of the Federal Reserve System (US). Retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/D2WLTGAL, 26 October 2023.

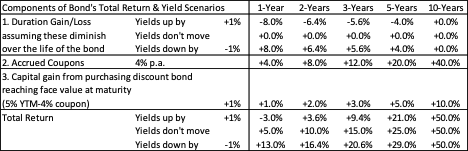

Given the recent rise in bond yields, with US 10-year bond yields at around 5%, the risk/reward to owning bonds looks increasingly attractive, especially for investors with longer than 2 years of investment horizon, as the coupons accrued from holding the bonds could offset any unexpected rise in bond yields. For example, a US 10-year bond with a duration of 8 years would potentially lose around 8% of market value if 10-year bond yield rises by 1%. However, a holding period of 2 years would allow the approximately 5% bond yield to accrue to 10%, which would more than offset the unexpected loss from duration. On the other hand, given that the FOMC economic projections expects to cut the Fed funds rate to 3.9% in the next two years, investors in 10-year US bond would stand to gain from duration by 8% if the 10-year bond yield declines by 1%, plus additional return from 2 years’ worth of bond yield of 10%, equivalent to 18% of total return over a 2-year holding period (ignoring other bond details in this case). Of course, there are additional elements to bond returns such as convexity or buying at a discounted price when the yield-to-maturity at around 5% is higher than the approximately 4% coupon rate, which means that there is a component of capital gain to face value when you hold it until maturity. This is shown in the exhibit below, but it is only meant to be a simplistic illustration only.

Exhibit: Total return from holding a 10yr US Treasury bond assuming YTM of 5%,

duration of 8yrs and coupon of 4% p.a.

Note: Simplified illustration only.

Source: Principal Asset Management. Data as of 30 October 2023.

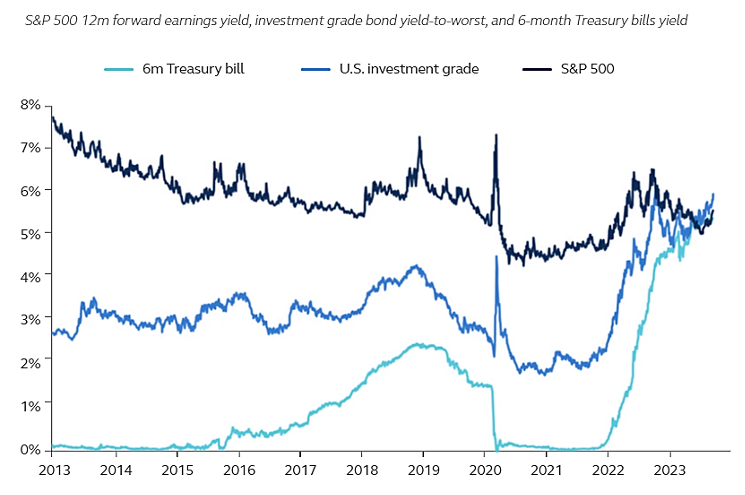

While 2023 has been a better year for bonds after last year’s bear market, the higher-for-longer narrative, which led to sharply rising interest rates during Q3, has acted as a significant headwind. The outlook for a US economic slowdown in 2024 suggests that, eventually, US Treasurys should deliver strong positive returns, while rising defaults may lead to stress in the lower-quality segments of the credit market. However, as clear signs of economic weakness may not be evident until early 2024, government bond yields may drift slightly higher in the near term, and credit is likely to continue outperforming. The bigger picture is that bonds can now generate more portfolio income than at any other time over the past 15 years. With investors today earning a higher yield on sovereign and high-grade corporate bonds than on equities, fixed income is finally more than just a diversification tool. (Written by Principal Global Insights Team, “Global Asset Allocation Viewpoints, Q4 2023 - The Last Mile”)

Chart: Yield Comparison: S&P 500, Investment Grade Bonds, and 6-month Treasury Bills

Note: US Investment grade represented by the Bloomberg US Corporate TR Value Unhedged USD Index.

Source: S&P Dow Jones, Federal Reserve, Bloomberg, Principal Asset Management. Data as of 30 September 2023.

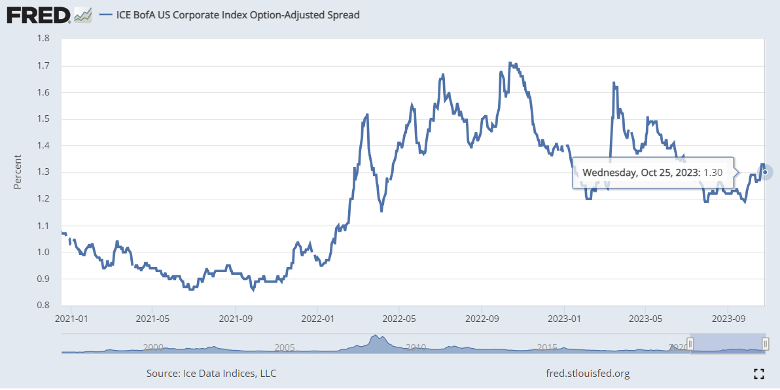

Investment grade bonds in the US are yielding around 6.3% in terms of effective yields over the entire maturity of the bonds. Even though this is only 1.3% of the yields of the US Treasurys, it is neither too cheap or too expensive at the current level. Despite the government bond selloff, IG spreads have continued to narrow, supported by stronger-than-expected economic growth and subdued default risk. Looking ahead, we believe that the slower economic growth in 2024 would benefit investment grades, which is a higher credit quality segment compared to high yields that should be more negatively effected by the oncoming recession in 2024. Meanwhile, the dividend yield of US equities of only 1.6% can hardly compete against IG credits yielding 6.3%, especially when IG credit’s volatility is only around half of US equity’s volatility. IG credits should be getting more asset allocation flows from other risky assets in 2024. We recommend readers to build an allocation to IG credits via our due to be launched Principal Global Credit Fund (PRINCIPAL GCREDIT) at the end of this month. Stay tuned.

Chart: ICE BofA US Investment Grade Corporate Bond Spread

Source: Ice Data Indices, LLC, ICE BofA US Corporate Index Option-Adjusted Spread [BAMLC0A0CM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A0CM. Data as of 28 October 2023.

Chart: ICE BofA US Investment Grade Corporate Bond Yield

Source: Ice Data Indices, LLC, ICE BofA US Corporate Index Effective Yield [BAMLC0A0CMEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A0CMEY. Data as of 28 October 2023.

Fund Recommendation

Principal Global Credit Fund (PRINCIPAL GCREDIT)

- PRINCIPAL GCREDIT has a policy to invest in or hold only investment unit of the foreign mutual fund BNY Mellon Global Credit Fund (Master Fund), share class W USD Acc, on average in the accounting yeart of not leass than 80% of the net asset value. The master fund registered in Luxembourg which managed by BNY Mellon Fund Management (Luxembourg) S.A.

- The Master Fund aims to achieve its investment objective by investing the majority of its Net Asset Value, meaning over 50%, in global credit markets. The remaining assets will be invested in non-credit debt and debt-related securities (debt and debt-related securities issued by governments, supra-nationals and public international bodies), currencies, cash and near cash assets

The fund is still being considered for approval by the SEC.

Read CIO View: October 2023 - Overweight Investment Grade Credit

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision / Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment / Past performance does not guarantee future results.