CIO View: August 2023 - Adding growth equity to satellite portfolio during market correction

By Supakorn Tulyathan, CFA-Chief Investment Officer

30 August 2023

The month of August did not contain a FOMC meeting. Nevertheless, the market was dominated by the outlook of further interest rate hikes by the Fed. The prospect of another rate hike has been coming into view as there remains three more FOMC meetings for the rest of this year—19 September, 31 October, and 12 December. Market participants focused on clues that might be offered by Fed Chair Jerome Powell, as he was due to deliver the keynote speech at the Jackson Hole Economic Symposium in Jackson Hole, Wyoming. Chair Powell emphasized that the Fed’s job is to steer the US economy to full employment and price stability. On the one hand, he sounded a bit hawkish by saying that inflation remains too high, raising the possibility of more rate hikes to bring inflation down to its 2% target. Although the hawkish message was tempered by his acknowledgement that raising rates too high could do some damage to the economy. This highlights the uncertainty facing the data-dependent central banks, while giving us a clue that policy stance is turning from a very aggressive tightening mode to a more careful assessment of two-sided risks. We had expected Powell to sound more balanced this time around, without giving a clear direction for a rate pause because we don’t think that the Fed wanted to take away the option to hike their policy rate further in case inflation failed to come down. Also, they don’t want to articulate their rate pause too soon, otherwise it could cause interest rate expectation and bond yields in the market to come down, thereby easing liquidity condition in the economy and providing a boost to economic activity and risk-taking sentiment in the market. As such, we remain of the view that risk of another rate hike by the Fed will continue to be an overhang for the market for the rest of this year, even though one might or might not actually come.

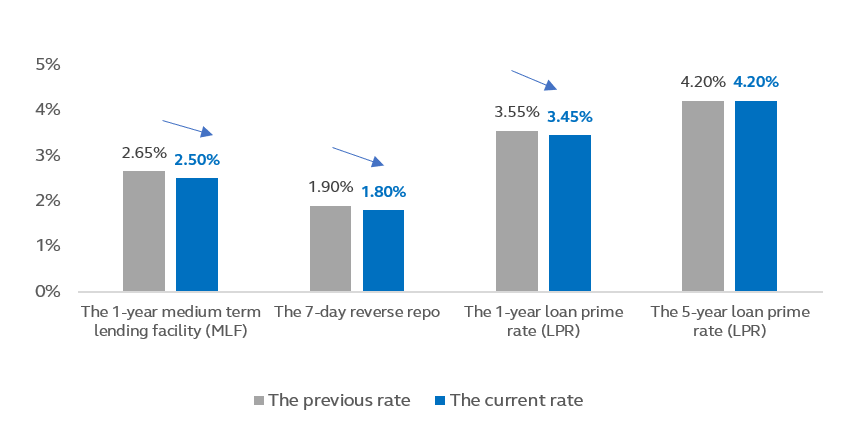

Elsewhere, we have become increasingly more cautious on China. Over the last two weeks, we had seen too little of policy rate cuts by the PBOC, when they delivered a surprised 15bp rate cut to the 1-year medium term lending facility (MLF), a surprised 10bp rate cut to the 7-day reverse repo, a less-than-expected 10bp rate cut to the 1-year loan prime rate (LPR), and a less-than-expected no cut on the 5-year loan prime rate (LPR). Most of China’s household and business loans are based on the 1-year LPR; however, China’s mortgages are based on the 5-year LPR. We think that this caution by the PBOC is motivated by concerns about the banking sector’s net interest margins (NIM) and the need to protect profitability of the big banks. This does raise additional concern that PBOC might not be able to adjust their monetary policies in a timely manner and with adequate magnitude to offset building economic headwinds, which will translate into an underperforming China’s GDP growth for the rest of the year. Over the weekend, several news sources reported that Chinese authorities have announced that they would be cutting the stamp duty on stock trading from 0.1% down to 0.05%—to be effective on Monday, 28 August 2023—in order to support the weak stock market sentiment in China. For now, we would prefer to wait and see if there will be more measures to directly stimulate the economy. Without more effective stimulus, we would prefer to use any short-term market bounce to reduce exposure.

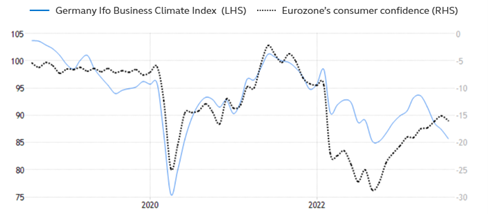

Another weak spot that has shown up is the Eurozone, where the recession risk there has been increasing. The release of the German ifo Business Climate Index for August saw deteriorating sentiment among German managers, with the index slipping to 85.7 points in August, from 87.4 points in July, reinforcing signal of German economic contraction. Eurozone’s consumer confidence also ended its recovery streak in August, with the indicator falling to -16 for the month from -15.1 in July, despite supports from falling inflation, ongoing job creation, and strong wage growth. We think that the outlook for Eurozone is weighed down even more by the deteriorating outlook for China due to the high linkages through the international trade channel. This does leave us with a more downbeat outlook for Europe and China versus the US for the rest of this year.

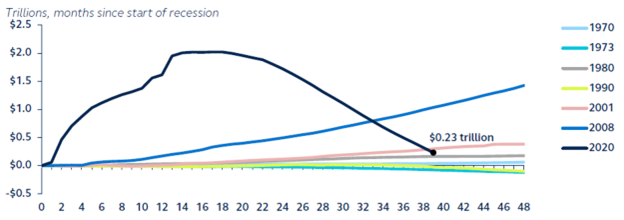

Meanwhile, the expert forecasters—the Global Insights team—at Principal Asset Management sitting in New York, Seattle, Des Moines and London have come out with an updated view on the recession outlook for the US economy. They think recession with be pushed out by a quarter to begin in Q1 of next year, instead of Q4 of this year, and will last for two quarters. Aside from the update of the timing shift, the key is that this will be a “soft recession”, meaning that they don’t expect a severe economic contraction to happen, and that it won’t be long-lasting. They do think that the slowdown will come from the rate hikes finally taking a toll on the economy. Additionally, the strength seen in the household sector of the US economy should begin to fade, as consumers have rundown their excess savings that had been a whopping $2 trillion in early 2021, but has almost been depleted at $0.2 trillion as of their most recent estimate. The weakness seen within the US equity markets have also coincided with a seasonality effect that have shown that August and September tend to be the weakest months for the stock markets, before making a rebound in October. This presents us with an opportune time to start accumulating growth stocks again during September, as we prepare for the final stretch of the year. The suitable candidate for this is our Principal Global Opportunity Fund (PRINCIPAL GOPP). Remember that we had cautioned against buying more growth-focus exposure starting in May, as we saw that the market rally had been unhealthy, which was led by just a few mega-cap tech names, while the rest of the market had been lagging significantly. PRINCIPAL GOPP has been lagging the NASDAQ 100 Index (our preferred index to look at mega cap movements) since May, and had been moving more or less in line with the S&P 500 Index. As the market has gone into a correction, starting in mid-July, another opportunity approaches to build up your growth exposure for Q4. We invite our readers to take a look at this fund. However, we caution against holding growth stock exposure as your core portfolio. We advise against making growth funds as your core portfolio due to their extremely high volatility and drawdowns that can happen quite frequently, which will feel uneasy to many investors. Therefore, our recommendation is to use PRINCIPAL GOPP only as a satellite equity fund for your portfolio only, while the core portfolio exposure should contain funds that are more stable and less volatile in order to reduce the concentration risk of high risk fund such as growth stocks in your core portfolio. Our current recommendation for core equity portfolio funds are: Principal Global Equity ESG Fund (PRINCIPAL GESG) and Principal Global Quality Equity Fund (PRINCIPAL GQE).

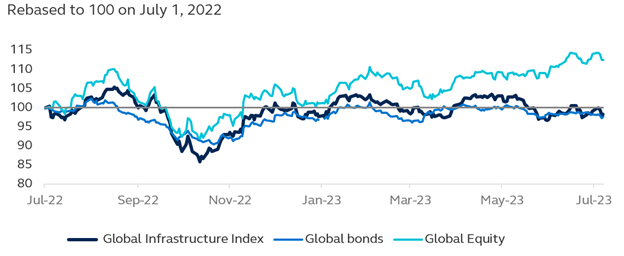

Our dear colleagues at the Global Insights team have also put forth another quick takes on capital market piece—“Bond sell-off: An opportune moment”, last Friday, 25 August 2023. Its key message is that the recent bond selloff has caused 10-year US Treasury yields to reach the highest level in over 15 years. However, with the growth outlook set to slow in 2024, this would eventually put downward pressure on bond yields; i.e., bond yields are nearing their peak. Therefore, given the elevated level of yields and the potential risk of muted growth next year, this could be an opportune time to add to duration exposure by adding fixed income to your portfolio. We couldn’t agree more that this is the best time to take advantage of the high bond yields that we have not seen since 2007. For multi-asset portfolios, fixed income is a very important component to achieve a suitable portfolio that is optimized for the best return given a unit of risk. We recommend readers to check out our Principal Global Fixed Income Fund (PRINCIPAL GFIXED) for your global fixed income exposure.

Chart: Aggregate excess savings following recession

Source: Bloomberg, Principal Asset Management. Data as of 30 June 2023.

Chart: China’s policy rates

Source: Bloomberg, Principal Asset Management. Data as of 27 August 2023.

Chart: Germany Ifo Business Climate Index and Eurozone’s consumer confidence

Source: Trading economics. Data as of 27 August 2023.

Chart: 10-year U.S. Treasury yield

Source: Bloomberg, Principal Asset Management. Data as of August 25, 2023.

Note: Peak and trough shown are for 2007–present time period.

Read CIO View: August 2023 - Adding growth equity to satellite portfolio during market correction

Disclaimer: Investors should understand product characteristics (mutual funds), conditions of return and risk before making an investment decision./ PRINCIPAL GOPP fund has highly concentrated investment in North America. So, investors have to diversify investment for their portfolios./ PRINCIPAL GESG Master fund has highly concentrated investment in United States. So, investors have to diversify investment for their portfolios./ PRINCIPAL GESG is not subject to sustainability disclosure, management and reporting requirements of mutual fund as SRI Fund of Thai SEC/ PRINCIPAL GQE Master fund has highly concentrated investment in United States./ Investing in Investment Units is not a deposit and there is a risk of investment, Investors may receive more or less return investment than the initial investment. Therefore, investors should invest in this fund when seeing that investing in this fund suitable for investment objectives of investors and investors accept the risk that may arise from the investment./ Investors should understand characteristic of mutual fund, return conditions and risk before investing Copyright @ 2023 Morningstar Thailand All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.